EXHIBIT 10.1(A)

Published on May 8, 2024

Exhibit 10.1(a)

EXECUTIVE EMPLOYMENT AGREEMENT

BETWEEN

VAALCO ENERGY, INC.

AND

THORPRUCKL

EFFECTIVE AS OF APRIL 18, 2024

SECOND AMENDED AND RESTATED EXECUTIVE EMPLOYMENT AGREEMENT

THIS SECOND AMENDED AND RESTATED EXECUTIVE EMPLOYMENT AGREEMENT (the "Agreement"), effective as of APRIL , 2024 (the "Effective Date"), is made and entered into by and between VAALCO Energy, Inc., a Delaware corporation (hereafter "Company") and Thor Pruckl (hereafter "Executive"). The Company and Executive may sometimes hereafter be referred to singularly as a "Party" or collectively as the "Parties."

W I T N E S S E T H:

WHEREAS, the Company desires to continue to secure the employment services of Executive subject to the terms and conditions hereafter set forth; and

WHEREAS, Executive is willing to enter into this Agreement upon the terms and conditions hereafter set forth; and

WHEREAS, this Agreement supersedes and replaces the Amended and Restated Executive Employment Agreement by and between the Parties dated February 6, 2024;

NOW, THEREFORE, in consideration of Executive's employment with the Company, and the mutual promises, covenants and obligations contained herein, the Parties hereby agree as follows:

ARTICLE 1.

EMPLOYMENT AND DUTIES

1.1 Definitions. In addition to the terms defined in the text hereof, terms with initial capital letters as used herein have the meanings assigned to them, for all purposes of this Agreement, in the Definitions Appendix hereto, unless the context reasonably requires a broader, narrower or different meaning. The Definitions Appendix, as attached hereto, is part of this Agreement and incorporated herein.

1.2 Employment; Effective Date. Effective as of the Effective Date and continuing for the Employment Period (as defined in Section 2.1), the Executive's employment by the Company shall be subject to the terms and conditions of this Agreement.

1.3 Positions. As of the Effective Date, the Executive will serve as the Chief Operating Officer of the Company ("COO"). The Company shall maintain the Executive in the position of COO of the Company, and/or in such other positions as the Parties mutually may agree, for the Employment Period.

1.4 Duties and Services. The Executive agrees to serve in the positions referred to in Section 1.3 and to perform diligently and to the best of his abilities the duties and services appertaining to such offices, as well as such additional duties and services appropriate to such offices upon which the Parties mutually may agree from time to time or, with respect to his duties as COO, that are assigned to him by the Chief Executive Officer of the Company ("CEO") or the Board of Directors of the Company (the "Board of Directors"). The Executive's employment shall also be subject to the policies maintained and established by the Company from time to time, as the same may be amended or otherwise modified. Executive shall at all times use his best efforts to in good faith comply with United States and foreign laws applicable to Executive's actions on behalf of the Company and its Affiliates. Executive understands and agrees that he may be required to travel extensively at times for purposes of the Company's business.

1.5 Other Interests. The Executive agrees that, during the Employment Period, he will devote his primary business time, energy and best efforts to the business and affairs of the Company and its Affiliates, and not to engage, directly or indirectly, in any other business or businesses, whether or not similar to that of the Company or an Affiliate, except with the consent of the Board of Directors. The foregoing notwithstanding, the Parties recognize and agree that the Executive may engage in passive personal investments (such as real estate investments and rental properties) and other civic and charitable activities (such as continued service on non-profit and/or educational boards) that do not conflict with the business and affairs of the Company or interfere with the Executive's performance of his duties hereunder without the necessity of obtaining the consent of the Board of Directors; provided, however, Executive agrees that if the Compensation Committee of the Board of Directors (the "Compensation Committee") determines that continued service with one or more civic or charitable entities is inconsistent with the Executive's duties hereunder and gives written notice to the Executive, he will promptly resign from such position(s).

1.6 Duty of Loyalty. The Executive acknowledges and agrees that the Executive owes a fiduciary duty of loyalty, fidelity, and allegiance to use his best efforts to act at all times in the best interests of the Company and its Affiliates. In keeping with these duties, the Executive shall make full disclosure to the Company of all business opportunities pertaining to the Company's business, and he shall not appropriate for the Executive's own benefit any business opportunity concerning the subject matter of such fiduciary relationship.

ARTICLE 2.

TERM AND TERMINATION OF EMPLOYMENT

2.1 Term of Employment. Unless otherwise terminated pursuant to other provisions hereof (including pursuant to a termination at will pursuant to Section 2.2), the Company agrees to continue to employ the Executive for the period beginning on the Effective Date and ending on the end of the day December 31, 2024 (the "Initial Term of Employment"). Beginning effective as of January 1, 2025 (the "Initial Extension Date"), the term of employment hereunder shall be extended automatically for an additional successive one-year period as of such date and as of each annual anniversary of the Initial Extension Date that occurs while this Agreement remains in effect so that the remaining term is one year.

The Initial Term of Employment, and any extension of employment hereunder, shall be referred to herein as a "Term of Employment." The entire period from the Effective Date through the date of Executive's termination of employment with the Company, for whatever reason, shall be referred to herein as the "Employment Period."

2.2 Notice of Termination. This Agreement may be terminated by the Company for any reason or no reason at all upon giving 90 days' written notice to the Executive, which notice shall be delivered pursuant to a Notice of Termination; provided, however, that the Company may reduce or eliminate, as applicable, such 90 day notice period by paying Executive an amount equal to (a) his Base Salary times (b) a fraction, (i) the numerator of which is the number of days that would remain in such 90 day notice period after Employee's termination and (ii) the denominator of which is the number of calendar days in the year in which such written notice is delivered (such payment, the "Notice Payment'} The Executive may terminate this Agreement upon giving 90 days' written notice to the Company, which notice shall be delivered pursuant to a Notice of Termination. For the avoidance of doubt, no further renewals of the Term of Employment hereunder shall occur pursuant to Section 2.1 after the giving of such Notice of Termination.

2.3 Resignations. Notwithstanding any other provision of this Agreement, upon the termination of the Executive's employment hereunder for any reason, unless otherwise requested by the Compensation Committee, Executive shall immediately resign from all officer positions and all boards of directors of the Company or any Affiliates of which he may then be a member. The Executive hereby agrees to execute any and all documentation of such resignations upon request by the Company, but he shall be treated for all purposes as having so resigned upon termination of his employment, regardless of when or whether he executes any such documentation.

ARTICLE 3.

COMPENSATION AND BENEFITS

3.1 Base Salary. During the Employment Period, the Executive shall receive a minimum annual base salary of $400,000, which shall be prorated for any period of less than 12 months (the "Base Salary"). The Compensation Committee shall review the Executive's Base Salary on an annual basis and may, in its sole discretion, increase, but not decrease, the Base Salary, and references in this Agreement to "Base Salary" shall refer to annual Base Salary as so increased. The Base Salary shall be paid in equal installments in accordance with the Company's standard policy regarding payment of compensation to executives, but no less frequently than monthly.

3.2 Annual Bonuses. For the 2024 calendar year and subsequent calendar years during the Employment Period, the Executive shall be eligible to receive an annual cash bonus (the "Annual Bonus") under the Company's annual incentive cash bonus plan for executives or any successor incentive cash bonus plan (the "Bonus Plan"), in an amount to be determined by the Compensation Committee, based on performance goals established by the Compensation Committee, in its discretion, pursuant to the terms of the Bonus Plan, and with a target percentage (the "Incentive Target Percentage") of 75% of the Executive's annual Base Salary as in effect at the beginning of the calendar year and may scale up or down based on achievement of personal and corporate goals established by the Compensation Committee.

3.3 Equity Awards after the Effective Date. During the Employment Period on and after the Effective Date, the Executive shall be eligible for stock options or other incentive awards in accordance with normal competitive pay practices, as part of the process and approach used for the Company's other senior executives, as determined by the Compensation Committee in its discretion. The annual long-term incentive award shall be up to 75% of Executive's Base Salary.

3.4 Business and Entertainment Expenses. Subject to the Company's standard policies and procedures with respect to expense reimbursement as applied to its executives generally, the Company shall reimburse the Executive for, or pay on behalf of the Executive, the reasonable and appropriate expenses incurred by the Executive for business related purposes, including dues and fees to industry and professional organizations and costs of entertainment and business development.

3.5 Vacation. During each full year of the Term of Employment, the Executive shall be entitled to 25 days of paid vacation in accordance with the Company's vacation policy, as in effect from time to time.

3.6 Employee and Executive Benefits Generally. During the Employment Period, the Executive shall be eligible for participation in all employee and executive benefits, including without limitation, qualified and supplemental retirement, savings and deferred compensation plans, medical and life insurance plans, and other fringe benefits, as in effect from time to time for the Company's most senior executives and subject to the terms of such plans; provided, however, that the Executive acknowledges and agrees that he shall not be a participant in, and he hereby waives any right to participate in, any severance plan (as the same may be amended from time to time) that generally covers the employees of the Company or its Affiliates such as to preclude duplicative severance benefits with those provided to Executive under the terms of this Agreement; provided, further, that the Company reserves the right to amend and termination any of such plans in its sole discretion.

3.7 Pension Benefits. During each calendar year of the Employment Period, beginning on the January 1, 2024 and pro-rated in the last calendar year of the Employment Period, as necessary, the Company shall pay to Executive an annual amount of US$17,000 as an allowance for him to invest in either a personal pension scheme or similar retirement funding as he may elect in his discretion.

3.8 Proration. Any payments payable to Executive hereunder in respect of any calendar year during which Executive is employed by the Company for less than the entire year, unless otherwise provided in the applicable plan or arrangement, shall be prorated in accordance with the number of days in such calendar year during which he is so employed.

3.9 Local Housing and Transportation. During the Employment Period, for such time as Executive's principal place of employment for the Company is in Houston, Texas, the Company will provide furnished leased housing and a leased vehicle to the Executive. Additionally, each time an amount for this leased housing or leased vehicle is included in the Executive's ordinary income and subject to withholding taxes, the Company shall make an additional payment to the Executive to cover any withholding taxes due on such amounts such that the after-tax amount received by the Executive for such pay stub is the same that the Executive would have received had he not received such leased housing or leased vehicle. For the avoidance of doubt, if such payments are made and included in income as supplemental wages separate from any other compensation, then the additional payment shall be made such that the Executive nets zero after such additional payment.

ARTICLE 4.

RIGHTS AND PAYMENTS UPON TERMINATION

|

4.1 |

Rights and Payments upon Termination. |

(a) In addition to any Notice Payment that the Company elects to pay to reduce or eliminate the notice period provided for in Section 2.2, and without limiting any other payments or benefits that Employee is entitled to receive under the terms of this Agreement or any employee benefit plan or program, Executive's right to compensation and benefits for periods after the Termination Date shall be limited to the following amounts:

(i) his accrued and unpaid Base Salary through the Termination Date;

(ii) his accrued and unused vacation days through the Termination Date; and

(iii) reimbursement of his reasonable business expenses that were incurred but unpaid as of the Termination Date.

(b) Any Notice Payment, together with such salary and accrued vacation days described in Section 4.1(a). shall be paid to Executive within five Business Days following the Termination Date in a cash lump sum less applicable withholdings. Business expenses shall be reimbursed in accordance with the Company's normal policy and procedures.

(c) Termination Benefits. In the event that during the Term of Employment Executive incurs a Severance Payment Event, the following severance benefits shall be provided to Executive hereunder or, in the event of his death before receiving all such benefits, to his Designated Beneficiary following his death:

(i) Additional Payment. The Company shall pay to Executive as additional compensation (the "Additional Payment"), an amount equal to fifty percent (50%) (in the event of a Regular Severance Payment Event), or one hundred percent (100%) (in the event of a CIC Severance Payment Event), multiplied by the aggregate sum of the following compensation items:

(A) Executive's Base Salary as in effect as of the Termination Date; plus

(B) an amount equal to the greater of (i) the average of Executive's Annual Bonus (or other cash incentive bonus) paid or payable to Executive by the Company for the two calendar years immediately preceding the calendar year in which the Termination Date occurs or (ii) Executive's Annual Bonus calculated at the Incentive Target Percentage for the full calendar year in which the Termination Date occurs; provided, however, in the event that the Termination Date occurs before the end of the calendar year, Executive shall be entitled to a prorata portion of the greater of clause (i) or (ii) above (based on the number of days in which he was employed during that year divided by 365).

Regardless of whether attributable to a Regular Severance Payment Event or a CIC Severance Payment Event, and subject to Section 4.1(c)(iii) in the event of an Anticipatory Termination, the Company shall make the Additional Payment to Executive over a six (6) month period in twelve (12), substantially equal bimonthly payments that begin within twenty (20) days following the Termination Date. The payment of any Additional Payment shall be made in accordance with, and subject to, the Release requirements of Section 4.3 and the Company's standard payroll procedures. The Company shall delay payments pursuant to Section 6.1 to the extent required to comply with the requirements of Code Section 409A. If Executive is a "specified employee" within the meaning of Code Section 409A, then payment of the Additional Payments otherwise payable during the first six (6) months following the Termination Date shall be deferred for six (6) months following the Termination Date (in accordance with Section 6.1) and such aggregate amount shall be paid within ten (10) days following the expiration of such 6-month period. Thereafter, the installment payments shall be made to Executive in accordance with the bi-monthly schedule set out above. In the event of Executive's death prior to the payment of all installments of the (1) Additional Payment as provided above, or (2) the Remaining Additional Payment Amount as provided in Section 4.l(b)(iii), the remaining installment payments shall be aggregated and paid in a single sum payment to the Executive's Designated Beneficiary within sixty (60) days from Executive's date of death.

(ii) Continued Group Health Plan Coverage. The Company and its Affiliates shall maintain continued group health plan coverage following the Termination Date under any of the Company's group health plans that covered Executive immediately before the Termination Date which are subject to the Consolidated Omnibus Budget Reconciliation Act of 1985, as amended, as codified in Code Section 4980B and Part 6 of Subtitle B of Title I of ERISA ("COBRA"), for Executive and his eligible spouse and other dependents (together, "Dependents"), for a period of one (1) year following the Termination Date and at no cost to Executive and his Dependents.

After the Termination Date, Executive, and his Dependents, if any, must first elect and maintain any COBRA continuation coverage under such plan that they are entitled to receive under the terms of such plan and COBRA. However, Executive and his Dependents shall not be required to make any premium payments for the portion of any such COBRA coverage period that does not extend beyond the maximum one-year period referenced above. In all other respects, Executive and his Dependents shall be treated the same as other COBRA qualified beneficiaries under the terms of such plan and the requirements of COBRA during the period while COBRA coverage remains in effect.

The continuation coverage described above shall be provided in a manner that is intended to satisfy an exception to Code Section 409A, and therefore not be treated as an arrangement providing for nonqualified deferred compensation that is subject to taxation under Code Section 409A.

(iii) Anticipatory Termination. Notwithstanding any provision of this Agreement to the contrary, in the event of an Anticipatory Termination, the Company shall compute the Additional Payment payable to Executive as the result of a CIC Severance Payment Event and offset from such amount the aggregate amount of the installments of the Additional Payment, if any, that were already paid to Executive through the Change in Control Date as the result of his Regular Severance Payment Event. The difference between the amount of Additional Payment attributable to the Executive's CIC Severance Payment Event and his Regular Severance Payment Event, as offset by any installment payments already made to Executive through the Change in Control Date, is defined as the "Remaining Additional Payment Amount". The Remaining Additional Payment Amount shall be paid to Executive in substantially equal, bi-monthly installment payments over the remaining term of the one-year period that is specified in Section 4.l(b)(i). The Remaining Additional Payment Amount shall be paid to Executive, as provided above, without the requirement that Executive enter into a new Release Agreement.

|

4.2 |

Limitation on Other Severance Benefits. |

(a) Limitation on Other Severance Payments. For purposes of clarity, in the event that (i) Executive voluntarily resigns or otherwise voluntarily terminates his own employment during the Term of Employment, except for due to his death or Disability, or (ii) Executive's employment is terminated due to a No Severance Benefits Event, then, in either such event under clause (i) or (ii), the Company shall have no obligation to provide the severance benefits described in subsection (i) of Section 4.l(c). Executive shall still be entitled to receive the minimum payments provided under Section 4.l(a).

(b) No Duplication of Severance Benefits. Notwithstanding Section 4.1, if Executive receives or is entitled to receive any severance benefit under any change of control policy, or any agreement with, or plan or policy of, the Company or any Affiliate, the amount payable under Section 4.1(c) to or on behalf of Executive shall be offset by such other severance benefits received by Executive, and Executive shall thus be entitled to receive the greater of such other severance benefits or the benefits provided under this Agreement, and not any duplicate benefits. The severance payments provided under this Agreement shall also supersede and replace any duplicative severance benefits under any severance pay plan or program that the Company or any Affiliate maintains for employees generally and that otherwise may cover Executive. For the avoidance of doubt, nothing in this Agreement shall be deemed to alter the provisions of any agreement granting equity based awards to Executive; nor shall anything in such agreements be deemed to alter the provisions of this Agreement.

4.3 Release Agreement. In order to receive the Termination Benefits, Executive must first execute the Release on a form provided by the Company. Pursuant to the Release, thereby Executive agrees to release and waive, in return for such severance benefits, any claims that he may have against the Company including, without limitation, for unlawful discrimination or retaliation (e.g., Title VII of the U.S. Civil Rights Act); provided, however, the Release shall not release any claim by or on behalf of Executive for any payment or benefit that is due and payable under the terms of this Agreement prior to the receipt thereof.

The Company shall deliver the Release to Executive within ten (10) days after the Employment Termination Date. The Executive must return the executed Release within the twenty-one (21) or forty-five (45) day period, as applicable, following the date of his receipt of the Release, and not revoke such Release such that the Release becomes effective no later than the sixtieth day following the Termination Date. If the conditions set forth in the preceding sentence are not satisfied by Executive, the Termination Benefits shall be forfeited hereunder.

If the Release delivery and non-revocation period spans two taxable years, the Termination Benefits will always be paid in the second taxable year. The Company shall also execute the Release. No Termination Benefits shall be payable or provided by the Company unless and until the Release has been executed by Executive, has not been revoked, and is no longer subject to revocation by Executive.

4.4 Notice of Termination. Any termination of employment by the Company or Executive shall be communicated by Notice of Termination to the other Party.

4.5 No Mitigation. Executive shall not be required to mitigate the amount of any payment or other benefits provided under this Agreement by seeking other employment.

ARTICLES.

CONFIDENTIAL INFORMATION AND RESTRICTIVE COVENANTS

5.1 Access to Confidential Information and Specialized Training. In connection with his employment and continuing on an ongoing basis during the Employment Period, the Company and its Affiliates will give Executive access to Confidential Information, which Executive did not have access to or knowledge of before the execution of this Agreement. Executive acknowledges and agrees that all Confidential Information is confidential and a valuable, special and unique asset of the Company that gives the Company an advantage over its actual and potential, current and future competitors. Executive further acknowledges and agrees that Executive owes the Company a fiduciary duty to preserve and protect all Confidential Information from unauthorized disclosure or unauthorized use, that certain Confidential Information constitutes "trade secrets" under applicable laws, and that unauthorized disclosure or unauthorized use of the Confidential Information would irreparably injure the Company or any Affiliate.

The Company also agrees to provide Executive with Specialized Training, which Executive does not have access to or knowledge of before the execution of this Agreement and continuing on an ongoing basis during his employment.

5.2 Agreement Not to Use or Disclose Confidential Information. Both during the term of Executive's employment and after his termination of employment for any reason (including wrongful termination), Executive shall hold all Confidential Information in strict confidence, and shall not use any Confidential Information except for the benefit of the Company or its Affiliates, in accordance with the duties assigned to Executive. Executive shall not, at any time (either during or after the term of Executive's employment), disclose any Confidential Information to any Person (except other Persons who have a need to know the information in connection with the performance of services for the Company or an Affiliate), or copy, reproduce, modify, decompile or reverse engineer any Confidential Information, or remove any Confidential Information from the Company's premises, without the prior written consent of the Compensation Committee, or permit any other Person to do so. Executive shall take reasonable precautions to protect the physical security of all documents and other material containing Confidential Information (regardless of the medium on which the Confidential Information is stored). This agreement and covenant applies to all Confidential Information, whether now known or later to become known to Executive.

The Executive shall hold in a fiduciary capacity for the benefit of the Company all Confidential Information relating to the Company or any of its Affiliates, and their respective businesses, that has been obtained by the Executive during the Executive's employment by the Company and which is not public knowledge (other than by acts of the Executive or representatives of the Executive in violation of this Agreement).

Following the termination of the Executive's employment with the Company for any reason, the Executive shall not, without the prior written consent of the Company or as may otherwise be required by law or legal process, communicate or divulge any such Confidential Information to any Person other than the Company and those designated by it.

The Company has and will disclose to the Executive, or place the Executive in a position to have access to or develop, trade secrets and Confidential Information of the Company or its Affiliates; and/or has and will place the Executive in a position to develop business goodwill on behalf of the Company or its Affiliates; and/or has and will entrust the Executive with business opportunities of the Company or its Affiliates. As part of the consideration for the compensation and benefits to be paid to the Executive hereunder; to protect the trade secrets and Confidential Information of the Company and its Affiliates that have been and will in the future be disclosed or entrusted to the Executive, the business goodwill of the Company and its Affiliates that has been and will in the future be developed in the Executive, or the business opportunities that have been and will in the future be disclosed or entrusted to the Executive.

5.3 Duty to Return Company Documents and Property. Upon the termination of Executive's employment with the Company and its Affiliates, for whatever reason, Executive shall immediately return and deliver to the Company any and all papers, books, records, documents, memoranda and manuals, e-mail, electronic or magnetic recordings or data, including all copies thereof, belonging to the Company or an Affiliate or relating to their businesses, in Executive's possession or under his control, and regardless of, whether prepared by Executive or others. If at any time after the Employment Period, Executive determines that he has any Confidential Information in his possession or under his control, Executive shall immediately return to the Company all such Confidential Information, including all copies (including electronic versions) and portions thereof.

Within one day after the end of the Employment Period for any reason, the Executive shall return to Company all Confidential Information which is in his possession, custody or control.

5.4 Further Disclosure. Executive shall promptly disclose to the Company all ideas, inventions, computer programs, and discoveries, whether or not patentable or copyrightable, which he may conceive or make, alone or with others, during the Employment Period, whether or not during working hours, and which directly or indirectly:

(a) relate to matters within the scope, field, duties or responsibility of Executive's employment with the Company; or

(b) are based on any knowledge of the actual or anticipated business or interest of the Company; or

(c) are aided by the use of time, materials, facilities or information of the Company.

Executive assigns to the Company, without further compensation, all rights, titles and interest in all such ideas, inventions, computer programs and discoveries in all countries of the world. Executive recognizes that all ideas, inventions, computer programs and discoveries of the type described above, conceived or made by Executive alone or with others within six months after termination of employment (voluntary or otherwise), are likely to have been conceived in significant part either while employed by the Company or as a direct result of knowledge Executive had of Confidential Information. Accordingly, Executive agrees that such ideas, inventions or discoveries shall be presumed to have been conceived during his employment with the Company, unless and until the contrary is clearly established by Executive.

5.5 Inventions. Any and all writings, computer software, inventions, improvements, processes, procedures and/or techniques which Executive may make, conceive, discover, or develop, either solely or jointly with any other Person, at any time during the Employment Period, whether at the request or upon the suggestion of the Company or otherwise, which relate to or are useful in connection with any business now or hereafter carried on or contemplated by the Company or an Affiliate, including developments or expansions of its present fields of operations, shall be the sole and exclusive property of the Company. Executive shall take all actions necessary so that the Company can prepare and present applications for copyright or Letters Patent therefor, and can secure such copyright or Letters Patent wherever possible, as well as reissue renewals, and extensions thereof, and can obtain the record title to such copyright or patents. Executive shall not be entitled to any additional or special compensation or reimbursement regarding any such writings, computer software, inventions, improvements, processes, procedures and techniques. Executive acknowledges that the Company from time to time may have agreements with other Persons which impose obligations or restrictions on the Company or an Affiliate regarding inventions made during the course of work thereunder or regarding the confidential nature of such work. Executive agrees to be bound by all such obligations and restrictions and to take all reasonable action which is necessary to discharge the obligations of the Company or an Affiliate with respect thereto.

5.6 Tolling. If Executive violates any of the restrictions contained in Sections 5.1 through 5.5, the restrictive period will be suspended and will not run in favor of Executive from the time of the commencement of any violation until the time when Executive cures the violation to the Company's reasonable satisfaction.

5.7 Reformation. It is expressly understood and agreed that the Company and the Executive consider the restrictions contained in this Article 5 to be reasonable and necessary to protect the Confidential Information and reasonable business interests of the Company or its Affiliates. Nevertheless, if any of the aforesaid restrictions are found by a court having jurisdiction to be unreasonable, or overly broad as to geographic area or time, or otherwise unenforceable, the Parties intend for the restrictions therein set forth to be modified by such court or arbitrator so as to be reasonable and enforceable and, as so modified, to be fully enforced in the geographic area and for the time period to the full extent permitted by law.

5.8 No Previous Restrictive Agreements. Executive represents that, except for agreements he disclosed in writing to the Company, he is not bound by the terms of any agreement with any previous employer or other Person to (a) refrain from using or disclosing any trade secret or confidential or proprietary information in the course of Executive's employment by the Company or (b) refrain from competing, directly or indirectly, with the business of such previous employer or any other Person. Executive further represents that his performance of all the terms of this Agreement and his work duties for the Company does not, and will not, breach any agreement to keep in confidence proprietary information, knowledge or data acquired by Executive in confidence or in trust prior to Executive's employment with the Company, and Executive will not disclose to the Company or induce the Company to use any confidential or proprietary information or material belonging to any previous employer or other Person.

5.9 Conflicts of Interest. In keeping with his fiduciary duties to Company, Executive hereby agrees that he shall not become involved in a conflict ofinterest, or upon discovery thereof, allow such a conflict to continue at any time during the Employment Period. Moreover, Executive agrees that he shall abide by the Company's Code of Conduct, as it may be amended from time to time, and immediately disclose to the Board of Directors any known facts which might involve a conflict of interest of which the Board of Directors was not aware.

5.10 Remedies. Executive acknowledges that the restrictions contained in this Article 5, in view of the nature of the Company's business, are reasonable and necessary to protect the Company's legitimate business interests, and that any violation of this Agreement would result in irreparable injury to the Company. In the event of a breach or a threatened breach by Executive of any provision of Article 5, the Company shall be entitled to a temporary restraining order and injunctive relief restraining Executive from the commission of any breach, and to recover the Company's attorneys' fees, costs and expenses related to the breach or threatened breach. Nothing contained in this Agreement shall be construed as prohibiting the Company from pursuing any other remedies available to it for any such breach or threatened breach, including, without limitation, the recovery of money damages, attorneys' fees, and costs. These covenants and disclosures shall each be construed as independent of any other provisions in this Agreement, and the existence of any claim or cause of action by Executive against the Company, whether predicated on this Agreement or otherwise, shall not constitute a defense to the enforcement by the Company of such covenants and agreements.

The Executive acknowledges that money damages would not be sufficient remedy for any breach of Article 5 by the Executive, and the Company shall also be entitled to specific performance as an available remedy for any such breach or any threatened breach. The remedies provided in this Section 5.10 shall not be deemed the exclusive remedies for a breach of Article 5, but shall be in addition to all remedies available at law or in equity.

5.11 No Disparaging Comments. Executive and the Company shall refrain from any criticisms or disparaging comments about each other or in any way relating to Executive's employment or separation from employment; provided, however, that nothing in this Agreement shall apply to or restrict in any way the communication of information by the Company or any of its Affiliates or by the Executive to any state or federal law enforcement agency. The Company and Executive will not be in breach of this covenant solely by reason of testimony or disclosure that is required for compliance with applicable law or regulation or by compulsion of law. A violation or threatened violation of this prohibition may be enjoined by a court of competent jurisdiction. The rights under this provision are in addition to any and all rights and remedies otherwise afforded by law to the Parties.

Executive acknowledges that in executing this Agreement, he has knowingly, voluntarily, and intelligently waived any free speech, free association, free press or First Amendment to the United States Constitution (including, without limitation, any counterpart or similar provision or right under the Texas Constitution or any other state constitution which may be deemed to apply) rights to disclose, communicate, or publish disparaging information or comments concerning or related to the Company or its Affiliate; provided, however, nothing in this Agreement shall be deemed to prevent Executive from testifying fully and truthfully in response to a subpoena from any court or from responding to an investigative inquiry from any governmental agency.

5.12 Company Documents and Property. All writings, records, and other documents and things comprising, containing, describing, discussing, explaining, or evidencing any Confidential Information, and all equipment, components, parts, tools, and the like in Executive's custody, possession or control that have been obtained or prepared in the course of Executive's employment with the Company shall be the exclusive property of the Company, shall not be copied and/or removed from the premises of the Company, except in pursuit of the business of the Company, and shall be delivered to the Company, without Executive retaining any copies or electronic versions, promptly upon notification of the termination of Executive's employment or at any other time requested by the Company. The Company shall have the right to retain, access, and inspect all property of any kind in the office or premises of the Company.

ARTICLE 6.

GENERAL PROVISIONS

6.1 Matters Relating to Section 409A of the Code. Notwithstanding any provision in this Agreement to the contrary, if the payment of any compensation or benefit provided hereunder (including, without limitation, any Termination Benefits) would be subject to additional taxes and interest under Section 409A of the Code ("Section 409A"), then the following provisions shall apply:

(a) Notwithstanding anything to the contrary in this Agreement, with respect to any amounts payable to Executive under this Agreement in connection with a termination of Executive's employment that would be considered "non-qualified deferred compensation" that is subject to, and not exempt under, Section 409A, a termination of employment shall not be considered to have occurred under this Agreement unless and until such termination constitutes Executive's Separation From Service.

(b) Notwithstanding anything to the contrary in this Agreement, to the maximum extent permitted by applicable law, the Termination Benefits provided to Executive pursuant to this Agreement shall be made in reliance upon Treasury Regulation Section 1.409A-l(b)(9)(iii) (relating to separation pay plans) or Treasury Regulation Section l.409A-l(b)(4) (relating to short-term deferrals). However, to the extent any such payments are treated as "non-qualified deferred compensation" subject to Section 409A, and if Executive is determined by the Company at the time of his Separation from Service to be a "specified employee" for purposes of Section 409A, then to the extent delayed payment of the Termination Benefits to which Executive is entitled under this Agreement is required in order to avoid a prohibited payment under Section 409A, such severance payment shall not be made to Executive before the earlier of (1) the expiration of the six month period measured from the date Executive's Separation from Service or (2) the date of Executive's death. Upon the earlier of such dates, all payments deferred pursuant to this Section 6.1 shall be paid in a lump sum to Executive (or to Executive's Designated Beneficiary in the event of his death). Each installment payment shall be treated as a separate payment for purposes of Section 409A.

(c) The determination of whether Executive is a "specified employee" for purposes of Section 409A at the time of his Separation from Service shall be made by the Company in accordance with the requirements of Section 409A.

(d) Notwithstanding anything to the contrary in this Agreement or in any separate Company policy, with respect to any in-kind benefits and reimbursements provided under this Agreement during any tax year of Executive shall not affect in-kind benefits or reimbursements to be provided in any other tax year of Executive and are not subject to liquidation or exchange for another benefit. Reimbursement requests must be timely submitted by Executive, and if timely submitted, reimbursement payments shall be made to Executive as soon as administratively practicable following such submission in accordance with the Company's policy regarding reimbursements, but in no event later than the last day of Executive's taxable year following the taxable year in which the expense was incurred. This Section 6.1 shall only apply to in-kind benefits and reimbursements that would result in taxable compensation income to Executive.

(e) This Agreement is intended to be written, administered, interpreted and construed in a manner such that no payment under this Agreement becomes subject to (1) the gross income inclusion under Section 409A or (2) the interest and additional tax under Section 409A (collectively, "Section 409A Penalties"), including, where appropriate, the construction of defined terms to have meanings that would not cause the imposition of the Section 409A Penalties. For purposes of Section 409A, each payment that Executive may be eligible to receive under this Agreement shall be treated as a separate and distinct payment and shall not collectively be treated as a single payment. If any provision of this Agreement would cause Executive to incur the Section 409A Penalties, the Company may, after consulting with Executive, reform such provision to comply with Section 409A or to preclude imposition of the Section 409A Penalties, to the full extent permitted under Section 409A.

6.2 Withholdings; Right of Offset. The Company may withhold and deduct from any benefits and payments made or to be made pursuant to this Agreement (a) all federal, state, local, foreign, and other taxes as may be required pursuant to any law or governmental regulation or ruling, (b) all other normal employee deductions made with respect to Company's employees generally, and (c) any advances made to Executive and owed to Company.

6.3 Nonalienation. The right to receive payments under this Agreement shall not be subject in any manner to anticipation, alienation, sale, transfer, assignment, pledge or encumbrance by Executive, his dependents or beneficiaries, or to any other Person who is or may become entitled to receive such payments hereunder. The right to receive payments hereunder shall not be subject to or liable for the debts, contracts, liabilities, engagements or torts of any Person who is or may become entitled to receive such payments, nor may the same be subject to attachment or seizure by any creditor of such Person under any circumstances, and any such attempted attachment or seizure shall be void and of no force and effect.

6.4 Incompetent or Minor Payees. Should the Compensation Committee determine, in its discretion, that any Person to whom any payment is payable under this Agreement has been determined to be legally incompetent or is a minor, any payment due hereunder, notwithstanding any other provision of this Agreement to the contrary, may be made in any one or more of the following ways: (a) directly to such Person; (b) to the legal guardian or other duly appointed personal representative of the individual or the estate of such Person; or (c) to such adult or adults as have, in the good faith knowledge of the Compensation Committee, assumed custody and support of such Person; and any payment so made shall constitute full and complete discharge of any liability under this Agreement in respect to the amount paid.

6.5 Successors and Assigns. This Agreement shall be binding upon and inure to the benefit of the Company and any successor of the Company (whether direct or indirect, by purchase, merger, consolidation or otherwise), and this Agreement shall inure to the benefit of and be enforceable by Executive's legal representatives. The Company shall require any successor (whether direct or indirect, by purchase, merger, consolidation or otherwise) to all or substantially all of the business and/or assets of the Company to assume expressly and agree to perform this Agreement in the same manner and to the same extent that the Company would be required to perform it if no such succession had taken place. As used in this Agreement, "Company" shall mean the Company as previously defined and any successor by operation of law or otherwise, as well as any successor to its business and/or assets as aforesaid which assumes and agrees to perform this Agreement. Except as provided in the preceding provisions of this Section 6.5. this Agreement, and the rights and obligations of the Parties hereunder, are personal in nature and neither this Agreement, nor any right, benefit, or obligation of either Party hereto, shall be subject to voluntary or involuntary assignment, alienation or transfer, whether by operation of law or otherwise, without the written consent of the other Party.

6.6 Notice. Each Notice or other communication required or permitted under this Agreement shall be in writing and transmitted, delivered, or sent by personal delivery, prepaid courier or messenger service (whether overnight or same-day), or prepaid certified United States mail (with return receipt requested), addressed (in any case) to the other Party at the address for that Party set forth below or under that Party's signature on this Agreement, or at such other address as the recipient has designated by Notice to the other Party.

|

To the Company: |

VAALCO Energy, Inc. 9800 Richmond Avenue, Suite 700 Houston, Texas 77042 Attention: Chief Executive Officer |

|

| To Executive: |

Thor Pruckl (as set forth below his signature) |

Each Notice or communication so transmitted, delivered, or sent (a) in person, by courier or messenger service, or by certified United States mail (return receipt requested) shall be deemed given, received, and effective on the date delivered to or refused by the intended recipient (with the return receipt, or the equivalent record of the courier or messenger, being deemed conclusive evidence of delivery or refusal), or (b) by email or facsimile shall be deemed given, received, and effective on the date of actual receipt (with the confirmation of transmission being deemed conclusive evidence of receipt, except where the intended recipient has promptly Notified the other Party that the transmission is illegible). Nevertheless, if the date of delivery or transmission is not a Business Day, or if the delivery or transmission is after 4:00 p.m. (local time at the recipient) on a Business Day, the Notice or other communication shall be deemed given, received, and effective on the next Business Day.

6.7 Mandatory Arbitration of Disputes. Except as provided in subsection_(h) of this Section 6.7, any Dispute must be resolved by binding arbitration in accordance with the following:

(a) Either Party may begin arbitration by filing a demand for arbitration in accordance with the Arbitration Rules and concurrently Notifying the other Party of that demand. If the Parties are unable to agree upon the choice of an arbitrator within 20 Business Days after the demand for arbitration was filed (and do not agree to an extension of that 20-day period), either Party may request the Houston, Texas, office of the American Arbitration Association ("AAA") to appoint the arbitrator in accordance with the Arbitration Rules. The arbitrator, as so appointed hereunder, is referred to herein as the "Arbitrator".

(b) The arbitration shall be conducted in the Houston, Texas metropolitan area, at a place and time agreed upon by the Parties with the Arbitrator, or if the Parties cannot agree, as designated by the Arbitrator. The Arbitrator may, however, call and conduct hearings and meetings at such other places as the Parties may mutually agree or as the Arbitrator may, on the motion of one Party, determine to be necessary to obtain significant testimony or evidence.

(c) The Arbitrator may authorize any and all forms of discovery upon a Party's showing of need that the requested discovery is likely to lead to material evidence needed to resolve the Dispute and is not excessive in scope, timing, or cost.

(d) The arbitration shall be subject to the Federal Arbitration Act and conducted in accordance with the Arbitration Rules to the extent that they do not conflict with this Section 6.7. The Parties and the Arbitrator may, however, agree to vary to provisions of this Section 6.7 or the matters otherwise governed by the Arbitration Rules.

(e) The arbitration hearing shall be held within 60 days after the appointment of the Arbitrator. The Arbitrator's final decision or award shall be made within 30 days after the hearing. That final decision or award by the Arbitrator shall be deemed issued at the place of arbitration. The Arbitrator's final decision or award shall be based on this Agreement and applicable law.

(f) The Arbitrator's final decision or award may include injunctive relief in response to any actual or impending breach of this Agreement or any other actual or impending action or omission by a Party in connection with this Agreement.

(g) The Arbitrator's final decision or award shall be final and binding upon the Parties, and judgment upon that decision or award may be entered in any court having jurisdiction. The Parties shall have any appeal rights afforded to them under the Federal Arbitration Act.

(h) Nothing in this Section 6.7 shall limit the right of either Party to apply to a court having jurisdiction to: (1) enforce the agreement to arbitrate in accordance with this Section 6.7; (2) seek provisional or temporary injunctive relief in response to an actual or impending breach of the Agreement or otherwise so as to avoid an irreparable damage or maintain the status quo, until a final arbitration decision or award is rendered or the Dispute is otherwise resolved; or (3) challenge or vacate any final Arbitrator's decision or award that does not comply with this Section 6.7. In addition, nothing in this Section 6.7 prohibits the Parties from resolving any Dispute (in whole or in part) by mutual agreement at any time, including, without limitation, through the use of personal negotiations or mediation with a third party.

(i) The Arbitrator may proceed to an award notwithstanding the failure of any Party to participate in such proceedings. The prevailing Party in the arbitration proceeding may be entitled to an award of reasonable attorneys' fees incurred in connection with the arbitration in such amount, if any, as determined by the Arbitrator in his discretion. The costs of the arbitration shall be borne equally by the Parties unless otherwise determined by the Arbitrator in the award.

G) The Arbitrator shall be empowered to impose sanctions and to take such other actions as it deems necessary to the same extent a judge could impose sanctions or take such other actions pursuant to the Federal Rules of Civil Procedure and applicable law. Each Party agrees to keep all Disputes and arbitration proceedings strictly confidential except for the disclosure of information required by applicable law.

(k) Executive acknowledges that by agreeing to this provision, he knowingly and voluntarily waives any right he may have to a jury trial based on any claims he has, had, or may have against the Company or an Affiliate, including any right to a jury trial under any local, municipal, state or federal law.

6.8 Severability. It is the desire of the Parties hereto that this Agreement be enforced to the maximum extent permitted by law, and should any provision contained herein be held unenforceable by a court of competent jurisdiction or arbitrator (pursuant to Section 6.7). the Parties hereby agree and consent that such provision shall be reformed to create a valid and enforceable provision to the maximum extent permitted by law; provided, however, if such provision cannot be reformed, it shall be deemed ineffective and deleted herefrom without affecting any other provision of this Agreement. This Agreement should be construed by limiting and reducing it only to the minimum extent necessary to be enforceable under then applicable law.

6.9 No Third-Party Beneficiaries. This Agreement shall be binding upon and inure to the benefit of the Parties hereto, and to their respective successors and permitted assigns hereunder, but otherwise this Agreement shall not be for the benefit of any Persons who are third parties.

6.10 Waiver of Breach. No waiver by either Party of a breach of any provision of this Agreement by the other Party, or of compliance with any condition or provision of this Agreement to be performed by the other Party, will operate or be construed as a waiver of any subsequent breach by the other Party or any similar or dissimilar provision or condition at the same or any subsequent time. The failure of either Party to take any action by reason of any breach will not deprive such Party of the right to take action at any time while such breach continues.

6.11 Survival of Certain Provisions. Wherever appropriate to the intention of the Parties, the respective rights and obligations of the Parties hereunder shall survive any termination or expiration of this Agreement or following the Executive's Termination Date.

6.12 Entire Agreement; Amendment and Termination. This Agreement contains the entire agreement of the Parties with respect to the matters covered herein; moreover, this Agreement supersedes all prior and contemporaneous agreements and understandings, oral or written, between the Parties concerning the subject matter hereof. This Agreement may be amended, waived or terminated only by a written instrument that is identified as an amendment, waiver or termination hereto and that is executed by or on behalf of each Party.

6.13 Defend Trade Secrets Act. Executive is hereby notified in accordance with the Defend Trade Secrets Act of 2016 that Executive will not be held criminally or civilly liable under any federal or state trade secret law for the disclosure of a trade secret that (a) is made (1) in confidence to a federal, state, or local government official, either directly or indirectly, or to an attorney; and (2) solely for the purpose of reporting or investigating a suspected violation of law; or (b) is made in a complaint or other document that is filed under seal in a lawsuit or other proceeding. If Executive files a lawsuit for retaliation against the Company for reporting a suspected violation of law, Executive may disclose the Company's trade secrets to Executive's attorney and use the trade secret information in the court proceeding if Executive files any document containing the trade secret under seal, and does not disclose the trade secret, except pursuant to court order.

6.14 Interpretive Matters. In the interpretation of the Agreement, except where the context otherwise requires:

(a) Headings. The Agreement headings are for reference purposes only and will not affect in any way the meaning or interpretation of this Agreement.

(b) The terms "including" and "include" do not denote or imply any limitation

(c) The conjunction "or" has the inclusive meaning ''and/or".

(d) The singular includes the plural, and vice versa, and each gender includes each of the others.

(e) The term "month" refers to a calendar month.

(0 Reference to any statute, rule, or regulation includes any amendment thereto or any statute, rule, or regulation enacted or promulgated in replacement thereof.

(f) The words "herein", "hereof', "hereunder" and other compounds of the word "here" shall refer to the entire Agreement and not to any particular provision;

(g) All amounts referenced herein are in U.S. dollars.

6.15 Governing Law; Jurisdiction. All matters or issues relating to the interpretation, construction, validity, and enforcement of this Agreement shall be governed by the laws of the State of Texas, without giving effect to any choice-of-law principle that would cause the application of the laws of any jurisdiction other than Texas. Jurisdiction and venue of any action or proceeding relating to this Agreement or any Dispute (to the extent arbitration is not required under Section 6.7) shall be exclusively in the federal and state courts of competent jurisdiction in the Houston, Texas metropolitan area.

6.16 Executive Acknowledgment. Executive acknowledges that (a) he is knowledgeable and sophisticated as to business matters, including the subject matter of this Agreement, (b) he has read this Agreement and understands its terms and conditions, (c) he has had ample opportunity to discuss this Agreement with his legal counsel prior to execution, and (d) no strict rules of construction shall apply for or against the drafter or any other Party. Executive represents that he is free to enter into this Agreement including, without limitation, that he is not subject to any covenant not to compete or other restrictive covenant that would conflict with his employment duties and covenants under this Agreement.

6.17 Counterparts. This Agreement may be executed in any number of counterparts, each of which when so executed and delivered shall be an original, but all such counterparts shall together constitute one and the same instrument. Each counterpart may consist of a copy hereof containing multiple signature pages, each signed by one Party hereto, but together signed by both Parties.

[Signature page follows.]

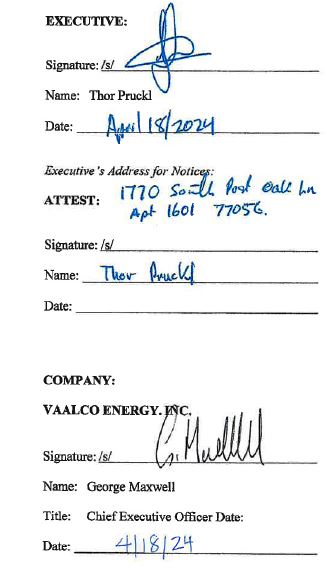

IN WITNESS WHEREOF, Executive has hereunto set his hand and Company has caused this Agreement to be executed in its name and on its behalf by its duly authorized officer, to be effective as of the Effective Date.

|

Signature Page to Executive Employment Agreement

APPENDIX A

Definitions Appendix

1. "Affiliate" has the same meaning ascribed to such term in Rule 12b-2 under the Securities Exchange Act of 1934, as amended from time to time.

2. "Anticipatory Termination" means a Separation From Service of the Executive within the time period that begins on the first day of the month that is twelve (12) months immediately preceding the first day of the month containing the Change in Control Date and ends on the Change in Control Date, but only if the Executive's Separation From Service was (a) due to a termination by the Company without Cause or (b) a termination by the Executive for Good Reason. For purposes of clarification and not limitation, a Separation From Service for Cause, or due to Executive's death or Disability or his voluntary resignation without Good Reason, is not an Anticipatory Termination.

3. "Arbitration Rules" means the Rules for Employment Arbitrations of the American Arbitration Association, as in effect at the time of arbitration of a Dispute.

4. "Board" means the then-current Board of Directors of the Company.

5. "Business Day" means any Monday through Friday, excluding any such day on which banks are authorized to be closed in Texas.

6. "Cause" shall mean the termination by the Company of the Executive's employment with the Company by reason of (a) the conviction of the Executive by a court of competent jurisdiction as to which no further appeal can be taken of a crime involving moral turpitude or a felony; (b) the commission by the Executive of a material act of fraud upon the Company or any Subsidiary, or any customer or supplier thereof; (c) the misappropriation of any funds or property of the Company or any Subsidiary, or any customer or supplier thereof, by the Executive; (d) the willful and continued failure by the Executive to perform the material duties assigned to him that is not cured to the reasonable satisfaction of the Company within 30 days after written notice of such failure is provided to Executive by the Board or the Compensation Committee (or by an officer of the Company who has been designated by the Board or the Compensation Committee for such purpose); (e) the engagement by the Executive in any direct and material conflict of interest with the Company or any Subsidiary without compliance with the Company's or Subsidiary's conflict of interest policy, if any, then in effect; or (f) the engagement by the Executive, without the written approval of the Board or the Compensation Committee, in any material activity which competes with the business of the Company or any Subsidiary or which would result in a material injury to the business, reputation or goodwill of the Company or any Subsidiary.

7. "Change in Control" means the occurrence of any one or more of the following events:

(a) The acquisition by any individual, entity or group (within the meaning of Section 13(d)(3) or 14(d)(2) of the Exchange Act (a "Person")) of beneficial ownership (within the meaning of Rule 13d-3 promulgated under the Exchange Act) of fifty percent (50%) or more of either (i) the then outstanding shares of common stock of the Company (the "Outstanding Company Stock") or (ii) the combined voting power of the then outstanding voting securities of the Company entitled to vote generally in the election of directors (the "Outstanding Company Voting Securities"); provided, however, that the following acquisitions shall not constitute a Change in Control: (i) any acquisition directly from the Company or any Subsidiary, (ii) any acquisition by the Company or any Subsidiary or by any employee benefit plan (or related trust) sponsored or maintained by the Company or any Subsidiary, or (iii) any acquisition by any corporation pursuant to a reorganization, merger, consolidation or similar business combination involving the Company (a "Merger"), if, following such Merger, the conditions described in Section 7.8(c) (below) are satisfied;

(b) Individuals who, as of the Effective Date, constitute the Board of Directors of the Company (the "Incumbent Board") cease for any reason to constitute at least a majority of the Board; provided, however, that any individual becoming a director subsequent to the Effective Date whose election, or nomination for election by the Company's shareholders, was approved by a vote of at least a majority of the directors then comprising the Incumbent Board shall be considered a member of the Incumbent Board, but excluding, for this purpose, any such individual whose initial assumption of office occurs as a result of either an actual or threatened election contest (as such terms are used in Rule 14a-l 1 of Regulation 14A promulgated under the Exchange Act) or other actual or threatened solicitation of proxies or consents by or on behalf of a Person other than the Board;

(c) The consummation of a Merger involving the Company, unless immediately following such Merger, (i) substantially all of the holders of the Outstanding Company Voting Securities immediately prior to Merger beneficially own, directly or indirectly, more than fifty percent (50%) of the common stock of the corporation resulting from such Merger (or its parent corporation) in substantially the same proportions as their ownership of Outstanding Company Voting Securities immediately prior to such Merger and (ii) at least a majority of the members of the board of directors of the corporation resulting from such Merger (or its parent corporation) were members of the Incumbent Board at the time of the execution of the initial agreement providing for such Merger;

(d) The sale consummation, or other disposition of all or substantially all of the assets of the Company, unless immediately following such sale or other disposition, (i) substantially all of the holders of the Outstanding Company Voting Securities immediately prior to the consummation of such sale or other disposition beneficially own, directly or indirectly, more than fifty percent (50%) of the common stock of the corporation acquiring such assets in substantially the same proportions as their ownership of Outstanding Company Voting Securities immediately prior to the consummation of such sale or disposition, and (ii) at least a majority of the members of the board of directors of such corporation (or its parent corporation) were members of the Incumbent Board at the time of execution of the initial agreement or action of the Board providing for such sale or other disposition of assets of the Company; or

(e) The approval by the stockholders of the Company or the Board of a plan for the complete liquidation or dissolution of the Company.

Notwithstanding the foregoing provisions of this Change in Control definition, to the extent that any payment (or acceleration of payment) under the Agreement is considered to be deferred compensation that is subject to, and not exempt under, Code Section 409A, then the term Change in Control hereunder shall be construed to have the meaning as set forth in Code Section 409A with respect to the payment (or acceleration of payment) of such deferred compensation, but only to the extent inconsistent with the foregoing provisions of this definition as determined by the Incumbent Board.

8. "Change in Control Date" means the first date upon which a Change in Control event occurs, provided that such date is during (a) the Employment Period or (b) the period following the Employment Period as specified in the definition of "Anticipatory Termination" if applicable.

9. "CIC Window Period" means (a) the time period beginning on the Change in Control Date and ending on the last day of the twelve (12) consecutive month period that begins immediately following the last day of the month containing the Change in Control Date, or (b) following an Anticipatory Termination, the occurrence of a Change in Control (which Change in Control must qualify as a "change in control event" within the meaning of Section 409A) within the period that is specified in the definition of "Anticipatory Termination".

10. "Code" means the Internal Revenue Code of 1986, as amended, or its successor. References herein to any Section of the Code shall include any successor provisions of the Code.

11. "Confidential Information" means any information or material known to, or used by or for, the Company or an Affiliate (whether or not owned or developed by the Company or an Affiliate and whether or not developed by Executive) that is not generally known by other Persons in the Business. For all purposes of the Agreement, Confidential Information includes, but is not limited to, the following: all trade secrets of the Company or an Affiliate; all non-public information that the Company or an Affiliate has marked as confidential or has otherwise described to Executive (either in writing or orally) as confidential; all non-public information concerning the Company's or Affiliate's products, services, prospective products or services, research, prospects, leases, surveys, seismic data, drilling data, designs, prices, costs, marketing plans, marketing techniques, studies, test data, leasehold and royalty owners, investors, suppliers and contracts; all business records and plans; all personnel files; all financial information of or concerning the Company or an Affiliate; all information relating to the Company's operating system software, application software, software and system methodology, hardware platforms, technical information, inventions, computer programs and listings, source codes, object codes, copyrights and other intellectual property; all technical specifications; any proprietary information belonging to the Company or an Affiliate; all computer hardware or software manuals of the Company or an Affiliate; all Company or Affiliate training or instruction manuals; all Company or Affiliate electronic data; and all computer system passwords and user codes.

12. "Designated Beneficiary" means Executive's surv1vmg spouse, if any, as determined for purposes of the Code. If there is no such surviving spouse at the time of Executive's death, then the Designated Beneficiary shall be Executive's estate.

13. "Disability" shall mean that Executive is entitled to receive long-term disability ("LTD") income benefits under the LTD plan or policy maintained by the Company or an Affiliate that covers Executive. If, for any reason, Executive is not covered under such LTD plan or policy, then "Disability" shall mean a "permanent and total disability" as defined in Code Section 22(e)(3) and Treasury regulations thereunder. Evidence of such Disability shall be certified by a physician acceptable to both the Company and Executive. In the event that the Parties are not able to agree on the choice of a physician, each shall select one physician who, in tum, shall select a third physician to render such certification. All costs relating to the determination of whether Executive has incurred a Disability shall be paid by the Company. Executive agrees to submit to any examinations that are reasonably required by the attending physician or other healthcare service providers to determine whether he has a Disability.

14. "Dispute" means any dispute, disagreement, controversy, claim, or cause of action arising in connection with or relating to this Agreement or Executive's employment or termination of employment hereunder, or the validity, interpretation, performance, breach, modification or termination of this Agreement.

15. "Good Reason" means, with respect to Executive, the occurrence of any one or more of the following events which first occurs during the Employment Period, except as a result of actions taken in connection with termination of Executive's employment for Cause or Disability, and without Executive's specific written consent:

(a) The assignment to Executive of any duties that are materially inconsistent with Executive's executive position, which in this definition includes status, reporting relationship to the Board of Directors, office, title, scope of responsibility over corporate level staff or operations functions, or responsibilities as an officer of the Company, or any other material diminution in Executive's position, authority, duties, or responsibilities, other than (in any case or circumstance) an isolated and inadvertent action not taken in bad faith that is remedied by the Company within thirty (30) Business Days after Notice thereof to the Company by Executive; or

(b) The Company requires Executive to be based at any office or location that is farther than forty (40) miles from Executive's principal office location located in the Houston, Texas metropolitan area, except for required business travel; or

(c) Any failure by the Company to obtain an assumption of this Agreement by its successor in interest, or any action or inaction that constitutes a material breach by the Company of this Agreement.

Notwithstanding the foregoing definition of "Good Reason", Executive cannot terminate his employment under the Agreement for Good Reason unless Executive (1) first provides written Notice to the Compensation Committee of the event (or events) that Executive believes constitutes a Good Reason event (above) within sixty (60) days from the first occurrence date of such event, and (2) provides the Company with at least thirty (30) Business Days to cure, correct or mitigate the Good Reason event so that it either (A) does not constitute a Good Reason event hereunder or (B) Executive specifically agrees, in writing, that after any such modification or accommodation by the Company, such event does not constitute a Good Reason event hereunder.

16. "Notice of Termination" means a written Notice which (a) indicates the specific termination provision in the Agreement that is being relied upon, (b) to the extent applicable, sets forth in reasonable detail the facts and circumstances claimed to provide a basis for termination of Executive's employment under the provision so indicated, and (c) if the Termination Date is other than the date ofreceipt of such Notice, specifies the termination date (which date shall be not more than sixty (60) days after the giving of such Notice). Any termination of Executive by the Company for Cause, or by Executive for Good Reason, shall be communicated by Notice of Termination to the other Party. The failure by Executive or the Company to set forth in the Notice of Termination any fact or circumstance that contributes to a showing of Good Reason or Cause shall not waive any right of such Party, or preclude such Party from asserting, such fact or circumstance in enforcing such Party's rights.

17. "No Severance Benefits Event" means termination of Executive's employment under the Agreement for Cause.

18. "Notice" means a written communication complying with Section 6.6 ("Notify" has the correlative meaning).

19. "Person" means any individual, firm, corporation, partnership, limited liability company, trust, or other entity, including any successor (by merger or otherwise) of such entity.

20. "Release" means a separation and release agreement, in such form as is prepared and delivered by the Company to Executive. The Release shall not release any claim by or on behalf of Executive for any payment or other benefit that is required under this Agreement prior to the receipt thereof, except as may otherwise be agreed to by Executive.

21. "Separation From Service" means Executive's "separation from service" with the Company and its Affiliates, as such term is defined under Code Section 409A.

22. "Severance Payment Event" means either a (a) "CIC Severance Payment Event" or (b) "Regular Severance Payment Event", as such terms are defined below.

(a) "CIC Severance Payment Event" means either: the Executive's Separation From Service with the Company and all Affiliates that occurs within the CIC Window Period, other than (1) voluntarily by the Executive unless such resignation is for Good Reason, (2) due to Executive's death or Disability, or (3) involuntarily by the Company for Cause. Any Separation From Service of the Executive that does not occur within the CIC Window Period, or is otherwise not described in this subsection (a), shall not be considered a CIC Severance Payment Event.

(b) "Regular Severance Payment Event" means a Separation From Service that is not a CIC Severance Payment Event and such Separation From Service is due to: (1) involuntary termination of Executive's Employment by the Company, except due to a