EX-19.1

Published on March 17, 2025

VAALCO Energy, Inc. INSIDER TRADING POLICY October 30, 2024 4870-4514-7136 v.2 EXHIBIT 19.1

4870-4514-7136 v.2 INSIDER TRADING POLICY CONTENTS PAGE 1. INTRODUCTION.............................................................................................................................................. 1 Purpose............................................................................................................................................................ 1 What Is Insider Trading? .................................................................................................................................. 1 What Securities are Subject to this Policy? ...................................................................................................... 1 Who is subject to this Policy?........................................................................................................................... 1 Family Members and Others Subject to this Policy .......................................................................................... 1 Questions......................................................................................................................................................... 2 Individual Responsibility ................................................................................................................................... 2 PDMRs and PDMR Associates......................................................................................................................... 2 2. STATEMENTS................................................................................................................................................. 2 Policy Prohibiting Insider Trading ..................................................................................................................... 2 Statement of Communications Policy ............................................................................................................... 3 3. DEFINITION OF MATERIAL, NON-PUBLIC INFORMATION ......................................................................... 3 What is Material Information?........................................................................................................................... 3 When Information Is “Public”?....................................................................................................................................... 4 4. BLACKOUT PERIODS .................................................................................................................................... 4 5. PRE-CLEARANCE .......................................................................................................................................... 5 6. NOTIFICATION AND DISCLOSURE............................................................................................................... 5 Notifications by PDMRs and their PDMR Associates........................................................................................ 5 Notification of major shareholdings in the UK................................................................................................... 6 7. SPECIAL AND PROHIBITED TRANSACTIONS............................................................................................. 6 8. TRANSACTIONS UNDER COMPANY PLANS................................................................................................ 7 9. GIFTS .............................................................................................................................................................. 8 10. RULE 10b5-1 PLANS...................................................................................................................................... 8 11. POST-TERMINATION TRANSACTIONS......................................................................................................... 8 12. CONSEQUENCES OF VIOLATION................................................................................................................. 8 13. CERTIFICATIONS UNDER THE POLICY........................................................................................................ 9

- 1 - 4870-4514-7136 v.2 1. INTRODUCTION Purpose The purpose of this Insider Trading Policy (this “Policy”) is to help VAALCO Energy, Inc. and its subsidiaries (the “Company”) comply with U.S. federal and state securities laws, UK securities laws and Canadian securities laws, and to preserve the reputation and integrity of the Company. As the Company is listed on both the NYSE and the LSE, it must comply with both U.S. and UK securities laws. The Company is also a reporting issuer in each province of Canada, making it subject to the Canadian securities laws of those jurisdictions. What Is Insider Trading? Insider trading is illegal and prohibited. Insider trading occurs when a person who is aware of “material, non-public information” (as it is known in the U.S.), “inside information” (as it is known in the UK) or “material information that has not been generally disclosed” (as it is known in Canada) (as defined below) about a company buys or sells that company’s securities or provides material, non-public information to another person who may trade, or recommends that another person trade on the basis of that information. References in this Policy to material, non-public information encompass references to inside information and material information that has not been generally disclosed. What Securities are Subject to this Policy? This Policy applies to purchases, sales, and exercises of the Company’s securities and derivative securities (e.g., common stock, units, warrants, as well as options, stock appreciations rights, puts, calls or other derivatives, whether or not issued by the Company) or any other type of securities that the Company may issue, such as preferred stock, convertible debentures and warrants (collectively, “Company Securities”). This Policy also prohibits trading in the securities of another company if you become aware of material, non-public information about that company in the course of your position with the Company. Who is subject to this Policy? This Policy applies globally to all directors, officers and employees of the Company and its subsidiaries as well as those acting on behalf of the Company, such as auditors, agents, and consultants (collectively, “Company Personnel”). PDMRs are officers, directors and employees of the Company or its subsidiaries (together the “Group”) who are members of the Group’s administrative, management or supervisory bodies who have regular access to material, non- public information relating directly or indirectly to the Company and the power to take managerial decisions affecting future developments and business prospects of the Company. This means the directors, the executive team and most other senior managers, including in-country management designated as PDMRs by the General Counsel (in consultation with the Chief Executive Officer and Chief Financial Officer) are PDMRs. A person whose role is limited to providing advice or recommendations to others, or to implementing decisions taken by others, will generally not be considered to be a PDMR. In addition, as specified in Section 4 of this Policy, (i) all PDMRs and PDMR Associates (as defined below) are subject to additional restrictions relating to trading in Company Securities during a Blackout Period (as defined below) and (ii) all PDMRs, and PDMR Associates are subject to additional restrictions relating to the pre-clearance of purchases or sales in Company Securities. Family Members and Others Subject to this Policy This Policy also applies to (i) anyone who lives in the household of Company Personnel (whether or not family members) and any family members who do not live in the household of Company Personnel, but whose transactions in Company Securities are directed by Company Personnel or are subject to their influence or control, such as parents

- 2 - 4870-4514-7136 v.2 or children who consult with Company Personnel before they trade in Company Securities (collectively referred to as “Family Members”); and (ii) any entities that are under the influence or control, including corporations, partnerships or trusts, of Company Personnel or their Family Members (collectively, “Controlled Entities”). Transactions by Family Members and Controlled Entities should be treated for the purposes of this Policy and applicable securities laws as if they were for the account of the Company Personnel. The Family Members and Controlled Entities of PDMRs are subject to additional restrictions, and are known for the purposes of this Policy as “PDMR Associates”. Questions Questions about this Policy or any proposed transaction should be directed to the Company’s General Counsel or outside legal counsel, as appropriate. Individual Responsibility You are responsible for making sure that (i) you; (ii) your Family Members; and (iii) your Controlled Entities comply with this Policy. In all cases, the responsibility for determining whether an individual is in possession of material, non-public information rests with that individual, and any action on the part of the Company, the General Counsel or outside legal counsel, as appropriate, or any other employee or director pursuant to this Policy (or otherwise) does not in any way constitute legal advice or insulate an individual from liability under applicable securities laws. You could be subject to severe legal penalties, including criminal proceedings, and disciplinary action by the Company for any conduct prohibited by this Policy or applicable securities laws, as described in Section 12 of this Policy. PDMRs and PDMR Associates The Company is required to maintain a list of PDMRs and PDMR Associates. All persons are required to cooperate with the Company and promptly provide all such information as the Company shall require to comply with this requirement. 2. STATEMENTS Policy Prohibiting Insider Trading No Trading on Material, Non-Public Information. If you are aware of material, non-public information about the Company, you may not, directly or indirectly, buy or sell Company Securities or engage in any other action to take advantage of that information in any capacity. It does not matter how you obtained this information. No Tipping. If you are aware of material, non-public information about the Company, you may not communicate or pass (“tip”) that information on to others outside the Company, including Family Members and friends. Additionally if you are aware of material, non-public information about the Company, you may not recommend or encourage another person or entity to purchase or sell any Company Securities. The federal securities laws impose liability on any person who tips (the “tipper”), or communicates material, non-public information to another person or entity (the “tippee”), who then trades on the basis of the information. Penalties may apply regardless of whether the tipper derives any benefits from the tippee’s trading activities. Canadian securities laws are even stricter since they impose liability on any person who tips another person or entity, even if the tippee does not then trade on the basis of that information. Canadian securities laws also impose liability on any person who is aware of material, non-public information and recommends or encourages the purchase or sale of securities on that basis, even if no trades are made on the basis of that recommendation or encouragement.

- 3 - 4870-4514-7136 v.2 Additional restrictions relating to the pre-clearance of purchases or sales in Company Securities applicable to all PDMRs and PDMR Associates are included in Section 5 of this Policy. PDMRs and PDMR Associates must also refrain from trading in Company Securities during a Blackout Period to avoid even the appearance of impropriety. In addition, it is our policy that Company Personnel who, in the course of working for the Company, learn of material, non-public information about a company with which the Company does business, including a customer or supplier of the Company, may not trade in, take advantage of, or pass information about that company’s securities until the information becomes public or is no longer material. Statement of Communications Policy The Company engages in communications with investors, securities analysts, and the financial press. It is against federal law – specifically, Regulation FD adopted by the Securities and Exchange Commission (the “SEC”) – as well as this Policy, for any person acting on behalf of the Company to selectively disclose material, non-public information to securities professionals (including, for example, buy and sell-side analysts, institutional investment managers, and investment companies) or investors in any Company Securities, under circumstances where it is reasonably foreseeable that the recipient may be likely to trade on the basis of such information, unless the information has first or simultaneously been disclosed to the public. Canadian securities laws are even stricter since they prohibit selective disclosure of material, non-public information to any person or entity, even if it is not reasonably foreseeable that the recipient may be likely to trade on the basis of such information. Any disclosure of information to securities professionals or investors in any Company Securities must therefore be made only after the information is disclosed to the public. 3. DEFINITION OF MATERIAL, NON-PUBLIC INFORMATION What is Material Information? You should consider material information as any information that a reasonable person would consider important in making a decision to buy, hold, or sell securities. Any information that could be expected to affect the price or value of Company Securities, whether it is positive or negative, should be considered material. There is no bright-line standard for assessing materiality; rather, materiality is based on an assessment of all of the facts and circumstances, and you should carefully consider how a transaction may be construed by enforcement authorities who will have the benefit of hindsight. Even if information is not material to the Company, it may be material to a customer, supplier, or other company with publicly traded securities. While it is not possible to define all categories of material information, some examples of information that ordinarily would be regarded as material are: A proposed acquisition, sale or joint venture; Projected future earnings or losses; Events or business operations which are likely to affect future revenues or earnings (for example, mergers, acquisitions and dispositions of properties, successful discoveries of oil and gas, unsuccessful wells, operational success or failure, and the execution of important contracts); A significant expansion or cutback of operations; Material changes in reserve estimates or production; Changes in executive management; Major lawsuits or legal settlements; Extraordinary customer quality claims; The commencement or results of regulatory proceedings; A proposed merger or tender offer; Changes to earnings guidance or projections, if any; The potential or actual gain or loss of a major customer or supplier; A significant corporate event or crisis; Company restructuring; A significant cybersecurity incident or event, such as a significant data breach or other unauthorized access to the

- 4 - 4870-4514-7136 v.2 Company’s information technology infrastructure; Borrowing activities, including contemplated financings and refinancings (other than in the ordinary course); A change in dividend policy, the declaration of a stock split, or an offering of additional securities; The establishment of a repurchase program for Company Securities; A change in auditors or notification that the auditor’s reports may no longer be relied upon; The imposition of a ban on trading in Company Securities or the securities of another company; or Impending bankruptcy or the existence of severe liquidity problems. When Information Is “Public”? Information that has not been disclosed to the public is generally considered to be non-public information. In order to establish that the information has been disclosed to the public, it may be necessary to demonstrate that the information has been widely disseminated. Filings with the SEC, announcements through RNS and press releases are generally regarded as public information. In Canada, disclosure by way of press release may be necessary to ensure that information is adequately disclosed to the public. By contrast, information would likely not be considered widely disseminated if it is available only to the Company’s employees, or if it is only available to a select group of analysts, brokers, and institutional investors. Once information is widely disseminated, it is still necessary to afford the investing public with sufficient time to absorb the information. As a general rule, information should not be considered fully absorbed by the marketplace until after two full business days have elapsed since the day on which the information is released. If, for example, the Company were to make an announcement after the opening of the markets on a Monday, you should not purchase or sell Company Securities until Thursday. Depending on the particular circumstances, the Company may determine that a longer or shorter period should apply to the release of specific material, non-public information. 4. BLACKOUT PERIODS All PDMRs, and PDMR Associates are subject to the Blackout Periods described below. Unless pursuant to a properly established Rule 10b5-1 Plan (as defined in Section 10 of this Policy and other highly limited circumstances in order to prevent inadvertent violations of the federal securities laws and to avoid even the appearance of trading on the basis of material, non-public information, PDMRs, and PDMR Associates may not conduct transactions (for their own or related accounts) involving the purchase or sale of Company Securities during the following periods (the “Blackout Periods”): As to any fiscal quarter, the period commencing forty-eight (48) hours before 12:00am (New York time) of the first day thereof, and ending at the first opening of the New York Stock Exchange that is at least forty- eight (48) hours after public disclosure of the financial results for the immediately preceding fiscal quarter or year, and any other period designated in writing by the Company’s General Counsel. If you are made aware of the existence of an event-specific Blackout Period, you should not disclose the existence of such Blackout Period to any other person. The safest period for trading in Company Securities, assuming the absence of material, non-public information, generally is the first ten trading days following the end of the Blackout Period. PDMRs will, as any quarter progresses, be increasingly likely to be aware of material, non-public information about the expected financial results for the quarter. If you have any question as to whether information or material is publicly available, please err on the side of caution and direct an inquiry to the Company’s General Counsel or outside legal counsel, as appropriate.

- 5 - 4870-4514-7136 v.2 5. PRE-CLEARANCE All PDMRs and PDMR Associates are subject to the Pre-Clearance restrictions described below, PDMRs and PDMR Associates may not give trading advice of any kind about the Company, whether or not such person is aware of material, non-public information. All PDMRs and PDMR Associates must clear purchases or sales in Company Securities with the Company’s General Counsel (or his/her designee) before the trade may occur in the form provided at Schedule 1, even if the proposed transaction is to take place outside of a Blackout Period. The General Counsel may designate and provide notice to other entities or individuals who may, from time to time, be subject to the pre- clearance procedures under this Policy. Requests for pre-clearance must be made in writing at least two (2) business days before the date of the proposed transaction. The General Counsel (or his/her designee) will inform the requesting individual of a decision with respect to the request as soon as possible after considering all the circumstances relevant to his/her determination. The General Counsel (or his/her designee) is under no obligation to approve a transaction submitted for pre-clearance, and may determine not to permit the transaction. If the General Counsel (or his/her designee) has not responded to a request for pre-clearance, do not trade in the Company’s Securities. If approved, the transaction must occur with two (2) business days after receipt of approval (so long as the transaction is not during a Blackout Period). If permission is denied, refrain from initiating any transaction in Company Securities, and do not inform any other person of the restriction. Pre-clearance may also be required for certain gifts and other transfers not involving the purchase or sale of Company Securities specified in Section 9 of this Policy. 6. NOTIFICATION AND DISCLOSURE The legislation in the U.S., the UK and Canada requires filings and public disclosures to be made in certain circumstances after PDMRs and PDMR Associates have dealt in Company Securities. Notifications by PDMRs and their PDMR Associates PDMRs and their PDMR Associates must make the following notifications in writing following every transaction conducted on their own account relating to Company Securities, including acquiring, disposing of or subscribing for Company Securities, or exercising options over the Company Securities. To the Company: Notification using the template in Schedule 2, promptly and no later than two business days after the date of the relevant transaction. On receipt of this notification UK securities laws requires that the Company must make the information public promptly and no later than three business days after the date of the relevant transaction. To the SEC: Under the US securities laws, directors, officers and greater than 10% beneficial owners of the Company’s common stock (each, a “Section 16 Insider”) are required to comply with the reporting obligations and limitations on short- swing transactions set forth in Section 16 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). The practical effect of these provisions is that (a) Section 16 Insiders will be required to report transactions in Company securities (usually within two business days of the date of the transactions) and (b) Section 16 Insiders who both purchase Even if approval to trade pursuant to the pre-clearance process is obtained in writing, or pre-clearance is not required for a particular transaction, PDMRs, and PDMR Associates may not trade in the Company Securities if he or she is aware of material, non-public information about the Company or any of the companies covered by this Policy. This Policy does not require pre-clearance of transactions in any other company’s securities unless otherwise indicated in writing by the Company’s General Counsel.

- 6 - 4870-4514-7136 v.2 and then sell Company securities within a six-month period will be required to disgorge all profits to the Company whether or not they had knowledge of any insider information. If you are a director or executive officer, you may be deemed to be an “affiliate” of the Company. Consequently, shares of Company common stock held by you may be considered to be “restricted securities” or “control securities”, the sale of which are subject to compliance with Rule 144 under the Securities Act of 1933, as amended. If this is the case, note that Rule 144 places limits on the number of shares you may be able to sell and provides that certain procedures must be followed before you can sell shares of Company common stock. To the UK’s Financial Conduct Authority (“FCA”): Notification using the notification form available on the FCA’s website: https://marketoversight.fca.org.uk/electronicsubmissionsystem/MaPo_PDMR_Introduction promptly and no later than three business days after the date of the relevant transaction. Notification to the FCA is not required where the aggregate of the value of a person’s notifiable transactions in any year does not exceed €5,000 (converted at the European Central Bank spot rate applicable at the end of the business day of completion of the relevant transaction). Note that for these purposes the value of a PDMR’s notifiable transactions is not aggregated with those of his or her PDMR Associates. The Company must announce the dealing within three business days of completion of the relevant transaction. In practice, the Company will notify the FCA on behalf of PDMRs and their PDMR Associates provided that they have provided the appropriate notification to the Company in good time. Notification of major shareholdings in the UK Under UK securities laws, a person must notify the Company of the percentage of voting rights in the Company’s shares that person holds as a shareholder (or holds or is deemed to hold through his direct or indirect holding of financial instruments) if, as a result of an acquisition or disposal of shares or financial instruments, the percentage of those voting rights reaches, exceeds or falls below 5%, 10%, 15%, 20%, 25%, 30%, 50% and 75%. This includes any change to a holding as a result of events changing the breakdown of voting rights – for example, an issue of shares that dilutes a person’s holding – irrespective of whether the person acquires or disposes of shares. It should be noted that a person is deemed to have an indirect holding of shares to the extent that he is entitled to acquire, dispose of or exercise voting rights in them, irrespective of whether he is the registered holder or beneficial; owner of them. Where a person has a notifiable interest he must notify the Company and the FCA within four trading days of the execution of the relevant trade using a Form TR1, available on the FCA’s website: https://www.fca.org.uk/sites/default/files/notifications-major-interests-shares-tr1-30-june_1.docx Notification to the FCA is via the email address majorshareholdings@fca.org.uk The Company is obliged to notify the market by the end of the third trading day after receiving notification. 7. SPECIAL AND PROHIBITED TRANSACTIONS The Company considers it improper and inappropriate for Company Personnel to engage in short-term or speculative transactions in Company Securities. It therefore is the Company’s policy that Company Personnel may not engage in any of the following transactions, or should otherwise consider the Company’s preferences as described below: Short-term Trading. PDMRs who purchase Company Securities in the open market may not sell any Company Securities of the same class during the six months following the purchase. In certain cases, a purchase and sale, or sale and purchase, within a six-month period of each other, may be prohibited under Section 16 of the Exchange Act. In addition, short-term trading of Company Securities by PDMRs may be distracting and may unduly focus on the Company’s short-term stock market performance instead of the Company’s long-term business objectives. Note that stock purchased through the Company’s equity plans and transactions with the Company are not subject to this restriction. Short Sales. Short sales (selling securities that you do not own, with the intention of buying the securities at a lower price in the future) of Company Securities are prohibited by this Policy. Short sales of the Company’s securities evidence an expectation on the part of the seller that the securities will decline in value, and therefore signal to the market that the seller has no confidence in the Company or its short-term prospects.

- 7 - 4870-4514-7136 v.2 Short sales may reduce the seller’s incentive to improve the Company’s performance. In addition, Section 16(c) of the Exchange Act prohibits directors and officers from engaging in short sales. Publicly Traded Options. Transactions in puts, calls, or other derivative securities, on an exchange or in any other organized market, are prohibited by this Policy. A transaction in options is, in effect, a bet on the short- term movement of the Company’s stock and therefore creates the appearance that trading is based on inside information. Transactions in options also may focus attention on short-term performance at the expense of the Company’s long-term objectives. See “Hedging Transactions” below. Margin Accounts and Pledges. Holding Company Securities in margin accounts or, without the prior consent of the Board of Directors of the Company or the Audit Committee, pledging Company Securities as collateral for loans or other obligations, is prohibited by this Policy. Hedging Transactions. Engaging in hedging transactions with respect to ownership in Company Securities, including trading in any derivative security relating to Company Securities is prohibited by this Policy. Certain forms of hedging or monetization transactions, such as zero-cost collars and forward sale contracts, allow you to lock in much of the value of your stock holdings, often in exchange for all or part of the potential for upside appreciation in the stock. These transactions allow you to continue to own the covered securities, but without the full risks and rewards of ownership. When that occurs, you may no longer have the same objectives as the Company’s other shareholders. Standing and Limit Orders. Standing and limit orders create heightened risks for insider trading violations similar to the use of margin accounts. There is no control over the timing of purchases or sales that result from standing instructions to a broker, and as a result the broker could execute a transaction when a PDMR or other employee is in possession of material, non-public information. The Company therefore discourages placing standing or limit orders on Company Securities. If a person subject to this Policy determines that they must use a standing order or limit order, the order should be limited to short duration and should otherwise comply with the restrictions and procedures outlined in this Policy. 8. TRANSACTIONS UNDER COMPANY PLANS This Policy does not apply in the case of the following transactions, except as specifically noted: Stock Option Exercises. The Company’s General Counsel (or other designee of the General Counsel) may grant an exemption from this Policy’s trading restrictions to permit the exercise of an employee stock option acquired pursuant to the Company’s plans, if any, to the exercise of a tax withholding right pursuant to which a person has elected to have the Company withhold stock subject to an option to satisfy tax withholding requirements, or the a cashless exercise of a stock option where the Company withholds stock to satisfy the exercise price. In granting an exception, the General Counsel may consider the size and timing of the exercise, the option expiration date and the nature of the MNPI currently known to the employee. This Policy’s trading restrictions do apply, however, to any sale of the underlying stock or to a cashless exercise of the option through a broker, as this entails selling a portion of the underlying stock to cover the cost of exercise. Restricted Stock Awards. This Policy’s trading restrictions do not apply to the vesting of restricted stock, or the exercise of a tax withholding right pursuant to which a person elected to have the Company withhold shares of stock to satisfy tax withholding requirements upon the vesting of any restricted stock. The Policy does apply, however, to any market sale of restricted stock. 401(k) Plan. If, and to the extent applicable, this Policy does not apply to purchases of Company Securities in the Company’s 401(k) plan resulting from periodic contribution of money to the plan pursuant to standard payroll deduction elections. This Policy does apply in the case of a change in the portion of contributions allocated to Company Securities. Other Similar Transactions. Any other similar purchase of Company Securities from the Company or sales of Company Securities to the Company are not subject to this Policy. 10b5-1 Trading Plans. Any Rule 10b5-1 Plan properly established in accordance with applicable SEC rules and the applicable rules of any other jurisdiction.

- 8 - 4870-4514-7136 v.2 9. GIFTS Bona fide gifts of Company securities are generally not transactions subject to this Policy, unless the person making the gift has reason to believe that the recipient intends to sell the Company securities while the donor is aware of material nonpublic information. However, where the gift is to a charitable organization, which will typically sell securities soon after receipt, the gift transaction is exempt from this Policy only where the donor reasonably believes that the charitable organization’s sale will not occur while the donor possesses material nonpublic information. For purposes of this Policy, a gift made to satisfy a previous commitment to make a cash gift or in payment of another obligation would not be deemed to be bona fide gift. In addition, individuals subject to pre-clearance requirements are required to pre- clear any bona fide gifts with the General Counsel. 10. RULE 10b5-1 PLANS Rule 10b5-1 under the Exchange Act provides a defense from insider trading liability under Rule 10b-5. In order to be eligible to rely on this defense, a person subject to this Policy must enter into a Rule 10b5-1 plan for transactions in Company Securities that meets certain conditions specified in the Rule (a “Rule 10b5-1 Plan”). If the plan meets the requirements of Rule 10b5-1, Company Securities may be purchased or sold without regard to certain insider trading restrictions, including blackout and pre-clearance requirements. To comply with this Policy, a Rule 10b5-1 Plan must be approved by the Company’s General Counsel and meet the requirements of Rule 10b5-1. In general, a Rule 10b5-1 Plan must be entered into in good faith at a time when the person entering into the plan is not aware of material, non-public information and not during a blackout period. Once the plan is adopted, the person must not exercise any influence over the amount of securities to be traded, the price at which they are to be traded, or the date of the trade. The plan must either specify the amount, pricing, and timing of transactions in advance or delegate discretion on these matters to an independent third party. Any Rule 10b5-1 Plan must be submitted for approval at least two weeks prior to the entry into the Rule 10b5-1 Plan unless this period is waived by the Company’s General Counsel. In addition, under SEC rules a Rule 10b5-1 Plan is subject to a certain specified “cooling off” period between entry into, or modification of, the plan and the first trade pursuant to the plan. A person subject to this Policy seeking to enter into a Rule 10b5-1 Plan is responsible for ensuring compliance with the requirements of Rule 10b5-1. 11. POST-TERMINATION TRANSACTIONS The Policy continues to apply to transactions in Company Securities even after your service with the Company has ended (other than the pre-clearance and trading prohibitions during a Blackout Period, which will cease to apply upon the expiration of any Blackout Period pending at the time of the termination of service). If you are aware of material, non-public information when your employment terminates, you may not purchase or sell Company Securities until that information has become public or is no longer material. 12. CONSEQUENCES OF VIOLATION Insider trading is a serious crime, with potential criminal liability. There are no limits on the size of a transaction that will trigger insider trading liability. Insider trading violations are pursued vigorously by the SEC, FCA and the Canadian securities regulators and can be detected using advanced technologies. In the past, relatively small trades have resulted in investigations by the SEC, FCA, the Canadian securities regulators or the Department of Justice and lawsuits. Individuals found liable for insider trading (and tipping) in the U.S. face penalties of up three (3) times the profit gained or loss avoided, a criminal fine of up to $5 million and up to twenty (20) years in jail. In addition to the potential criminal and civil liabilities, in certain circumstances the Company may be able to recover all profits made by an insider who traded illegally plus collect other damages. Furthermore, the Company (and its executive officers and directors) could face penalties of the greater of $2,166,279 or three (3) times the profit gained or loss avoided as a result of an employee’s violation and/or criminal penalty of up to $25 million.

- 9 - 4870-4514-7136 v.2 Similar penalties exist in the UK, with insider dealing punishable by imprisonment of up to seven years and/or a fine, while FCA has the additional power to:

- 10 - 4870-4514-7136 v.2 Impose an unlimited penalty on that person; or Make a public statement to the effect that a person has engaged in market abuse; or Prohibit that individual from managing or dealing in shares; or Suspending that person’s permission to carry on a regulated activity. Without regard to civil or criminal penalties that may be imposed by others, willful violation of this Policy and its procedures may constitute grounds for, among other things, dismissal from the Company. Needless to say, a violation of law, or even an SEC investigation that does not result in prosecution, can tarnish one’s reputation and irreparably damage a career. 13. CERTIFICATIONS UNDER THE POLICY Each PDMR must certify initially that such individual has read and is in compliance with this Policy and will abide by its provisions in the future.

- 11 - 4870-4514-7136 v.2 CERTIFICATE OF COMPLIANCE I (Print name) hereby certify that I have received, read and understand the foregoing “Insider Trading Policy.” I further certify that I am in compliance with, and will continue to adhere to, the policies and procedures set forth therein and understand that my failure so to adhere could subject me to dismissal from the Company or removal from the Board of Directors for cause. Date: Signature: Title: If you have any questions, please contact the Company’s General Counsel or outside legal counsel, as appropriate.

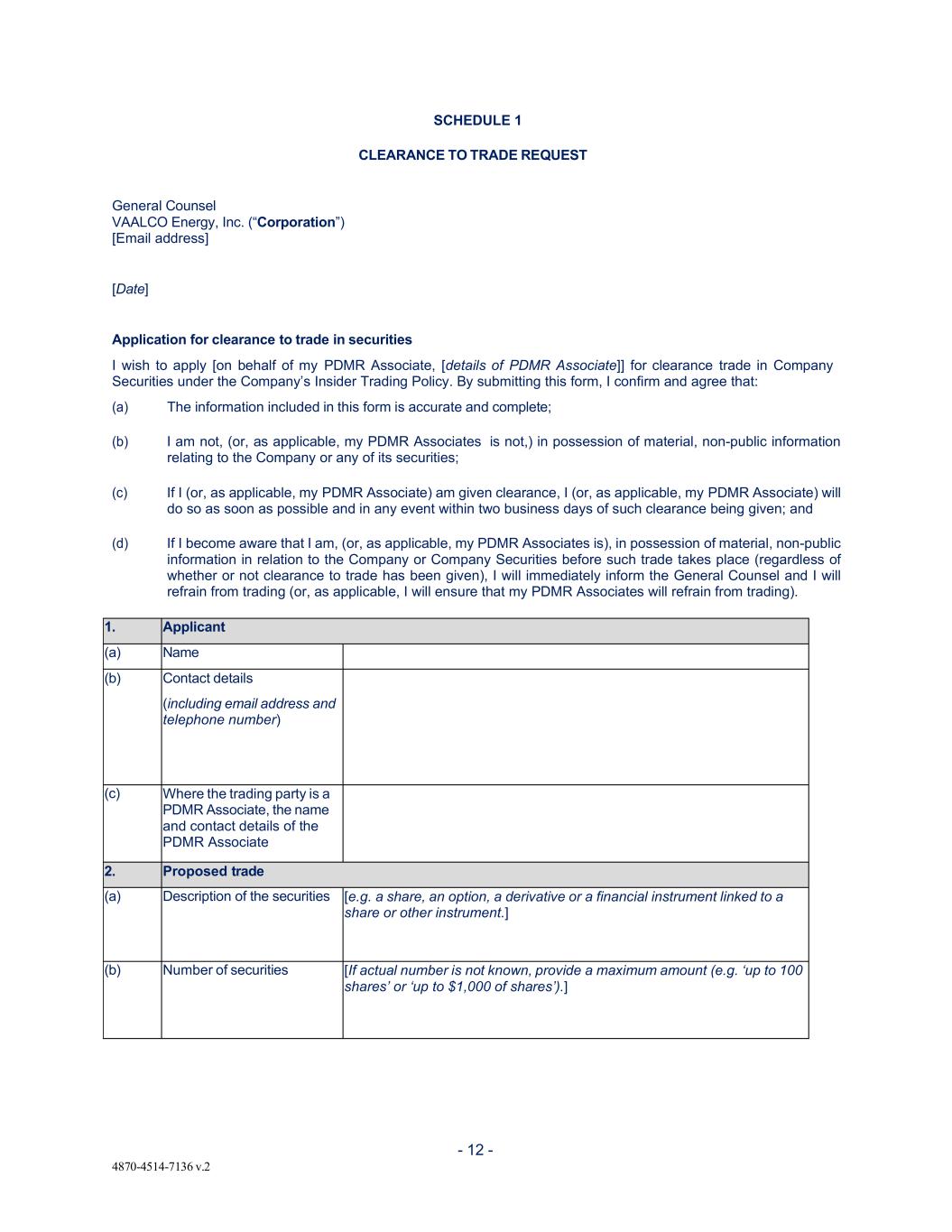

- 12 - 4870-4514-7136 v.2 SCHEDULE 1 CLEARANCE TO TRADE REQUEST General Counsel VAALCO Energy, Inc. (“Corporation”) [Email address] [Date] Application for clearance to trade in securities I wish to apply [on behalf of my PDMR Associate, [details of PDMR Associate]] for clearance trade in Company Securities under the Company’s Insider Trading Policy. By submitting this form, I confirm and agree that: (a) The information included in this form is accurate and complete; (b) I am not, (or, as applicable, my PDMR Associates is not,) in possession of material, non-public information relating to the Company or any of its securities; (c) If I (or, as applicable, my PDMR Associate) am given clearance, I (or, as applicable, my PDMR Associate) will do so as soon as possible and in any event within two business days of such clearance being given; and (d) If I become aware that I am, (or, as applicable, my PDMR Associates is), in possession of material, non-public information in relation to the Company or Company Securities before such trade takes place (regardless of whether or not clearance to trade has been given), I will immediately inform the General Counsel and I will refrain from trading (or, as applicable, I will ensure that my PDMR Associates will refrain from trading). 1. Applicant (a) Name (b) Contact details (including email address and telephone number) (c) Where the trading party is a PDMR Associate, the name and contact details of the PDMR Associate 2. Proposed trade (a) Description of the securities [e.g. a share, an option, a derivative or a financial instrument linked to a share or other instrument.] (b) Number of securities [If actual number is not known, provide a maximum amount (e.g. ‘up to 100 shares’ or ‘up to $1,000 of shares’).]

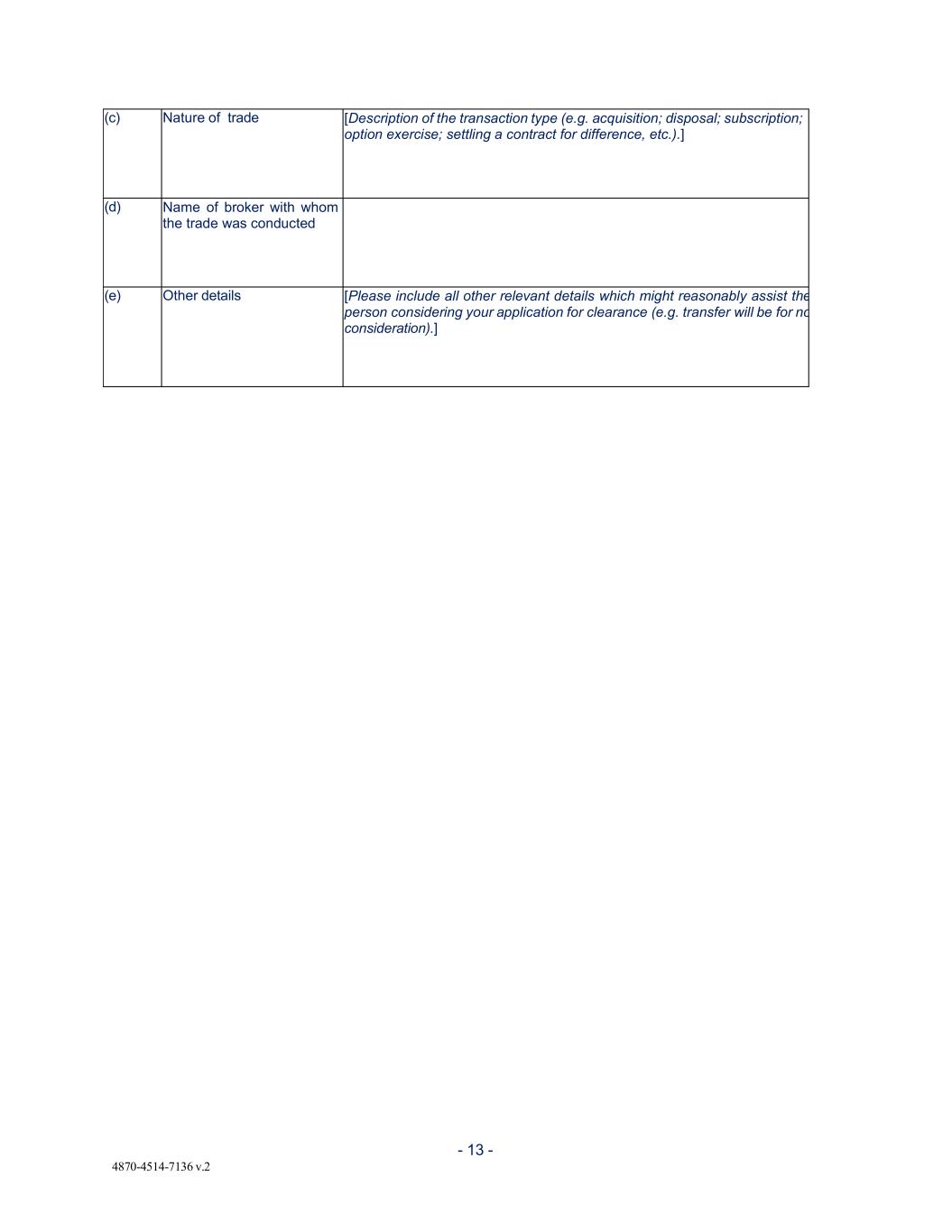

- 13 - 4870-4514-7136 v.2 (c) Nature of trade [Description of the transaction type (e.g. acquisition; disposal; subscription; option exercise; settling a contract for difference, etc.).] (d) Name of broker with whom the trade was conducted (e) Other details [Please include all other relevant details which might reasonably assist the person considering your application for clearance (e.g. transfer will be for no consideration).]

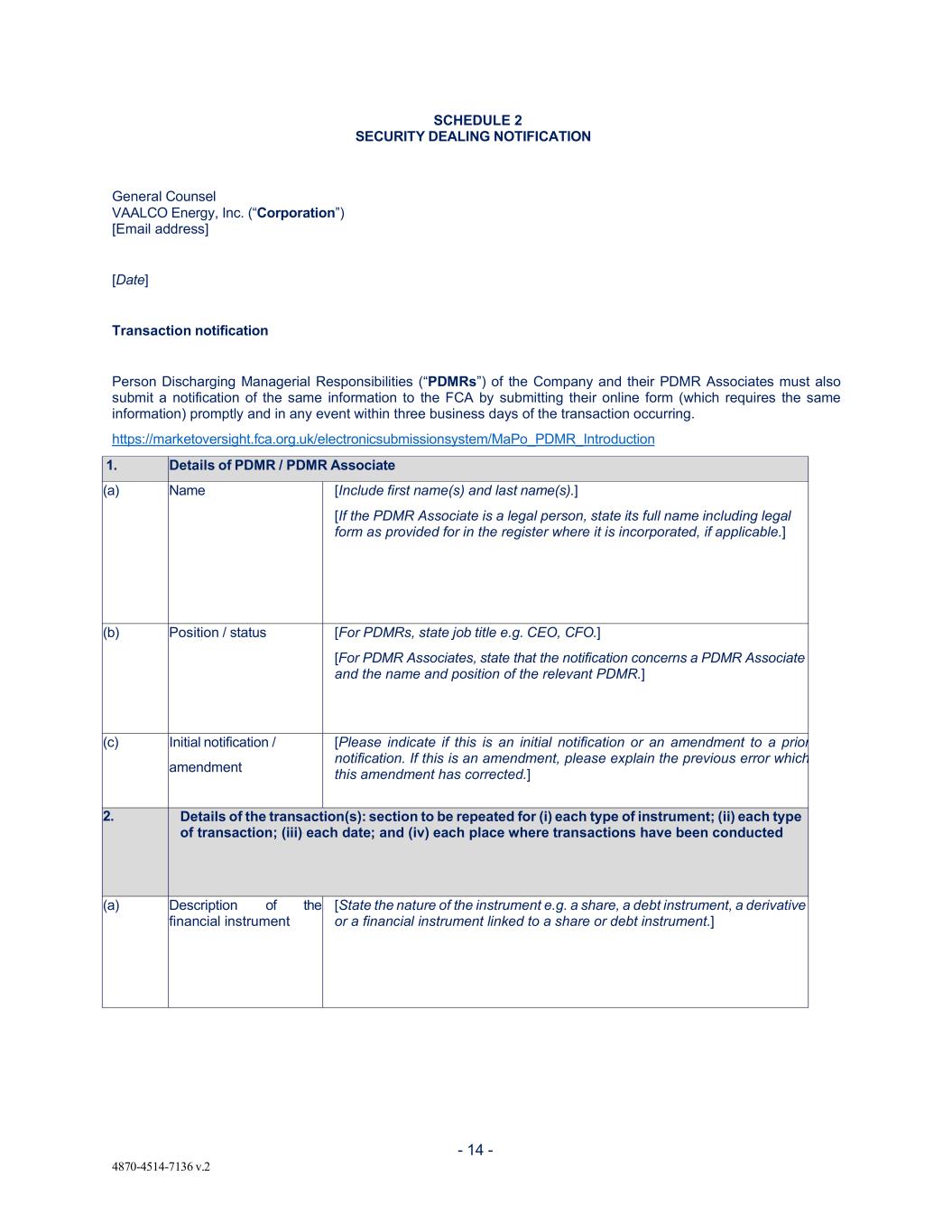

- 14 - 4870-4514-7136 v.2 SCHEDULE 2 SECURITY DEALING NOTIFICATION General Counsel VAALCO Energy, Inc. (“Corporation”) [Email address] [Date] Transaction notification Person Discharging Managerial Responsibilities (“PDMRs”) of the Company and their PDMR Associates must also submit a notification of the same information to the FCA by submitting their online form (which requires the same information) promptly and in any event within three business days of the transaction occurring. https://marketoversight.fca.org.uk/electronicsubmissionsystem/MaPo_PDMR_Introduction 1. Details of PDMR / PDMR Associate (a) Name [Include first name(s) and last name(s).] [If the PDMR Associate is a legal person, state its full name including legal form as provided for in the register where it is incorporated, if applicable.] (b) Position / status [For PDMRs, state job title e.g. CEO, CFO.] [For PDMR Associates, state that the notification concerns a PDMR Associate and the name and position of the relevant PDMR.] (c) Initial notification / amendment [Please indicate if this is an initial notification or an amendment to a prior notification. If this is an amendment, please explain the previous error which this amendment has corrected.] 2. Details of the transaction(s): section to be repeated for (i) each type of instrument; (ii) each type of transaction; (iii) each date; and (iv) each place where transactions have been conducted (a) Description of the financial instrument [State the nature of the instrument e.g. a share, a debt instrument, a derivative or a financial instrument linked to a share or debt instrument.]

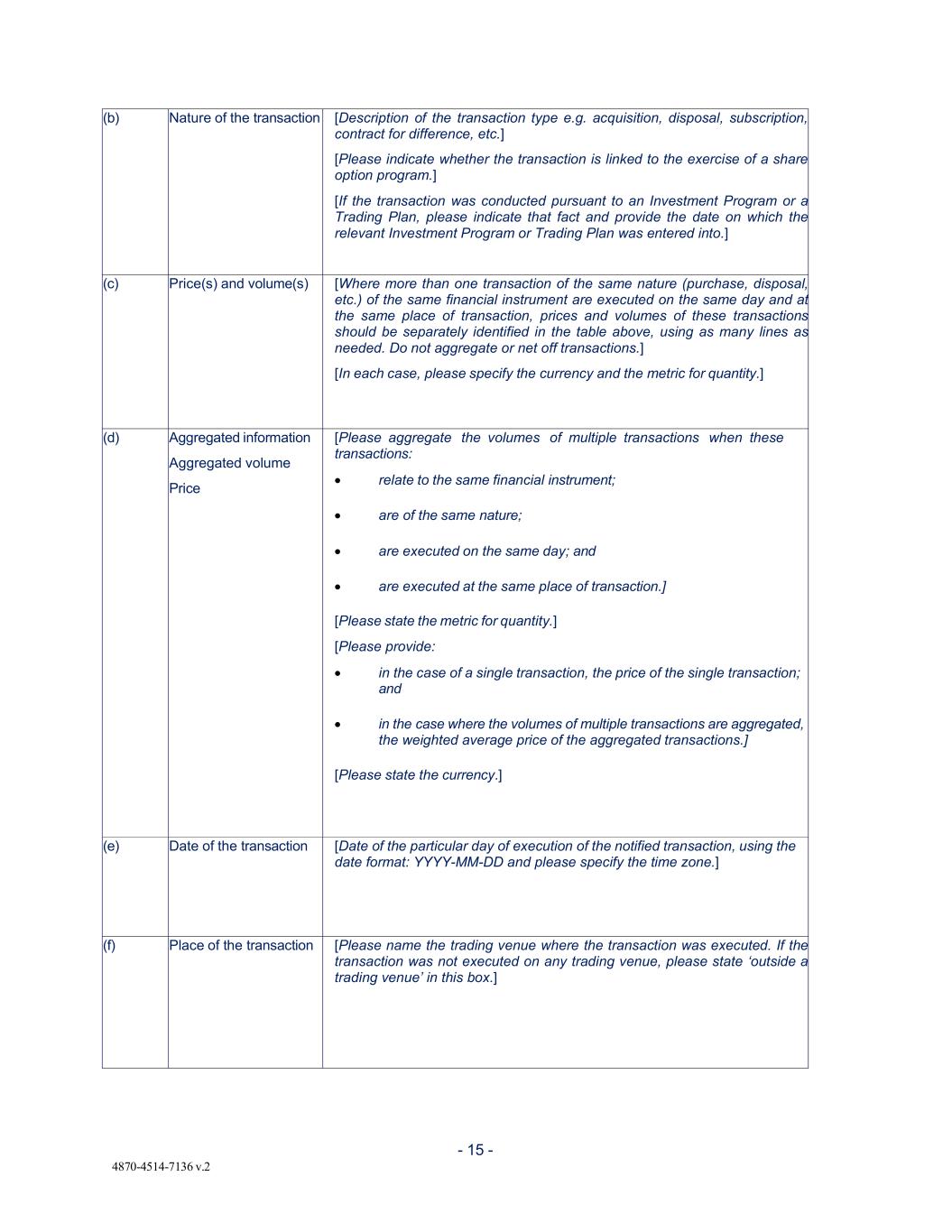

- 15 - 4870-4514-7136 v.2 (b) Nature of the transaction [Description of the transaction type e.g. acquisition, disposal, subscription, contract for difference, etc.] [Please indicate whether the transaction is linked to the exercise of a share option program.] [If the transaction was conducted pursuant to an Investment Program or a Trading Plan, please indicate that fact and provide the date on which the relevant Investment Program or Trading Plan was entered into.] (c) Price(s) and volume(s) [Where more than one transaction of the same nature (purchase, disposal, etc.) of the same financial instrument are executed on the same day and at the same place of transaction, prices and volumes of these transactions should be separately identified in the table above, using as many lines as needed. Do not aggregate or net off transactions.] [In each case, please specify the currency and the metric for quantity.] (d) Aggregated information Aggregated volume Price [Please aggregate the volumes of multiple transactions when these transactions: relate to the same financial instrument; are of the same nature; are executed on the same day; and are executed at the same place of transaction.] [Please state the metric for quantity.] [Please provide: in the case of a single transaction, the price of the single transaction; and in the case where the volumes of multiple transactions are aggregated, the weighted average price of the aggregated transactions.] [Please state the currency.] (e) Date of the transaction [Date of the particular day of execution of the notified transaction, using the date format: YYYY-MM-DD and please specify the time zone.] (f) Place of the transaction [Please name the trading venue where the transaction was executed. If the transaction was not executed on any trading venue, please state ‘outside a trading venue’ in this box.]