DEF 14A: Definitive proxy statements

Published on April 25, 2025

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

PROXY STATEMENT PURSUANT TO SECTION 14(A) OF THE

SECURITIES EXCHANGE ACT OF 1934

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ | Preliminary Proxy Statement | |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| ☒ | Definitive Proxy Statement | |

| ☐ | Definitive Additional Materials | |

| ☐ | Soliciting Material Pursuant to §240.14a-12 | |

(NAME OF REGISTRANT AS SPECIFIED IN ITS CHARTER)

(NAME OF PERSON(S) FILING PROXY STATEMENT, IF OTHER THAN THE REGISTRANT)

Payment of Filing Fee (Check all boxes that apply):

| ☒ | No fee required. | |

| ☐ | Fee paid previously with preliminary materials. | |

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

VAALCO ENERGY, INC.

A Letter from the Board of Directors

Dear Fellow Shareholders:

Over the past two years, we have delivered record breaking operational and financial results while meeting or exceeding our quarterly guidance targets. Maintaining operational excellence and consistent production across our portfolio is essential to expanding Adjusted EBITDAX which has allowed us to grow inorganically and to fund organic growth initiatives, better positioning Vaalco for the future.

In 2024, we generated net income of $58.5 million, record Adjusted EBITDAX of $303 million, and had record production of almost 25,000 working interest barrels equivalent per day(1), with record sales of almost 20,000 net revenue interest(2) barrels per day. Our SEC proved reserves grew 57% year-over-year to 45 million barrels of oil equivalent (“MMBOE”) thanks in part to the Svenska acquisition that we completed in April 2024. We accomplished all of this while sustaining our commitment to returning cash to shareholders in 2024 and over the past two years, we have returned $83 million of cash to our shareholders through our ongoing dividend program and share buybacks. We have positive momentum as we enter 2025, both operationally and financially, and we are building size, scale and profitability to sustainably grow Vaalco.

Our strategy remains unchanged: operate efficiently, invest prudently, maximize our asset base, and look for accretive opportunities. Our ability to execute this strategy has enabled us to deliver record growth and profitability over the past three years and we are poised to deliver more in the future. Across our diversified asset base, we have a multitude of projects to execute in the coming years. In Gabon, we have an extensive drilling campaign planned at Etame that we expect to add reserves and production. The FPSO refurbishment project in Cote d’Ivoire has already begun and we are working with the operator on the development drilling program that should begin in 2026. Also, in Cote d’Ivoire, we will be acquiring additional regional well data, licensing seismic data and conducting further geological evaluations of our newest block CI-705, where we are the operator with a 70% working interest. We have additional drilling campaigns planned in Egypt and Canada to help offset decline. In Equatorial Guinea, we are progressing the front-end engineering and design study and looking to take the project to final investment decision in the first half of 2025. Our entire organization is actively working to deliver sustainable growth and strong results to continue funding our capital programs, while also returning value to our shareholders through a top-quartile dividend.

On behalf of Vaalco’s executive management and employee team, we want to thank all of our shareholders for your continued support. Your vote is very important to us, and we encourage you to review the enclosed proxy statement and to promptly vote to ensure that your shares are represented at the Annual Meeting.

Signed,

The Board of Directors

(1) All WI production rates and volumes are Vaalco’s working interest volumes.

(2) All net revenue interest (“NRI”) production rates and volumes are Vaalco’s working interest volumes less royalty volumes, where applicable.

| We have elected to furnish proxy materials to our shareholders on the Internet pursuant to rules adopted by the Securities and Exchange Commission. We believe these rules enable us to provide you with the information you need, while making delivery more efficient, more cost effective and friendlier to the environment. In accordance with these rules, beginning on or about April 25, 2025, we sent a Notice of Internet Availability of Proxy Materials to our shareholders. |

2025 PROXY STATEMENT

2024 Full Year Highlights

| $ | 58.5M | $ | 33.0M | ||

| Reported net income of $58.5 million ($0.56 per diluted share) | Returned $33.0 million of cash to shareholders through dividends and share buybacks | ||||

| $ | 113.7M | $ | 303.0M | ||

| Net cash from operating activities of $113.7 million; | Generated record Adjusted EBITDAX of $303.0 million | ||||

| +7% | +57% | ||||

| Grew production by 7% year-over-year to 19,936 NRI barrels of oil equivalent per day (“BOEPD”) for 2024 |

|

Increased year-end proved reserves by 57% to 45.0 MMBOE | |||

| $ | 109.4M | $ | 82.6M | ||

| Integrated a major acquisition and invested over $109.4 million in a capital program focused on development drilling programs in Egypt and Canada, as well as maintenance, project costs and long lead items for Gabon and Côte d’Ivoire | Cash at December 31, 2024 was $82.6 million, while remaining bank debt free | ||||

2025 Accomplishments to Date

| Entered into new reserves-based revolving credit facility with an initial commitment of $190 million with the ability to grow to $300 million, secured by Vaalco’s Gabon, Egypt and Côte d’Ivoire assets. | Acquired 70% WI in and will operate the CI-705 block in offshore Côte d’Ivoire. |

VAALCO ENERGY, INC.

Notice of Annual Meeting of Shareholders

To the Shareholders of VAALCO Energy, Inc.: The 2025 Annual Meeting of Shareholders of Vaalco Energy, Inc. (the “Company”) will be held at the Hilton Houston Westchase, 9999 Westheimer Road, Houston, Texas 77042 on Thursday, June 5, 2025, at 9:00 a.m. Central Time (the “Annual Meeting”). We intend to hold our annual meeting in person.

The Annual Meeting is being held:

| 1. | To elect five directors, each for a term of one year; |

| 2. | To ratify the appointment of KPMG LLP as the Company’s independent registered public accounting firm for 2025; |

| 3. | To approve, on an advisory basis, the compensation of our named executive officers; |

| 4. | To transact such other business as may properly come before the Annual Meeting or any adjournments, postponements, or recesses thereof. |

These proposals are described in the accompanying proxy materials. You will be able to vote at the Annual Meeting, or any adjournment, postponement or recess thereof, only if you were a shareholder of record at the close of business on April 11, 2025.

We are providing our shareholders access to our proxy materials over the internet. To do this, we are mailing a Notice of Internet Availability of Proxy Materials (the “Notice”) on or about April 25, 2025. The Notice contains instructions on how to access those documents over the internet, and how to request a paper copy of our proxy materials.

|

Admission An admission ticket or proof of stock ownership is required to enter the Annual Meeting. See page 15, “Voting and Other Procedures Related to the Annual Meeting” for further information. |

|

Date

Thursday, June 5, 2025 |

|

Time

9:00 a.m. Central Time |

|

Place

Hilton Houston Westchase 9999 Westheimer Road Houston, Texas 77042 |

Shareholders may request to receive proxy materials in printed form by mail or electronically by email on an ongoing basis. Shareholders who receive future proxy materials by email will save us the cost of printing and mailing documents and will reduce the impact of meetings of shareholders on the environment. A shareholder’s election to receive proxy materials by email will remain in effect until the shareholder terminates that election.

By Order of the Board of Directors,

Andrew L. Fawthrop

Chair of the Board

Houston, Texas

April 25, 2025

YOUR VOTE IS IMPORTANT!

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE ANNUAL MEETING OF THE SHAREHOLDERS TO BE HELD ON JUNE 5, 2025, AT 9:00 A.M., CENTRAL TIME:

The Proxy Statement and our Annual Report for 2024 are available at www.proxyvote.com.

If you have any questions or need assistance voting your shares, please call our proxy solicitor:

D.F. King & Co., Inc.

48 Wall Street, 22nd Floor

New York, NY 11005

Banks and Brokerage Firms, please call: (212) 365-6884

Shareholders, please call toll free: (866) 620-2535

2025 PROXY STATEMENT

Table of Contents

VAALCO ENERGY, INC.

Proxy Statement

2025 Annual Meeting of Shareholders

This Proxy Statement is provided in connection with the solicitation of proxies by our Board of Directors (the “Board”) to be voted at our 2025 Annual Meeting of Shareholders (our “Annual Meeting”), and at any postponement, adjournment or recess of the Annual Meeting.

In this Proxy Statement, Vaalco Energy, Inc. is referred to as the “Company,” “our company,” “we,” “our,” “us” or “Vaalco.”

Matters To Be Voted On

| Item for Business | Board Vote Recommendation | Further Details | |

| 1. | Election of five directors | FOR EACH DIRECTOR NOMINEE | 19 |

| 2. | Ratification

of the appointment of independent registered public accounting firm |

FOR | 38 |

| 3. | Advisory resolution on executive compensation | FOR | 42 |

YOUR VOTE IS IMPORTANT

WHETHER OR NOT YOU PLAN TO ATTEND THE MEETING, WE ENCOURAGE YOU TO VOTE AND SUBMIT YOUR PROXY BY INTERNET, TELEPHONE OR MAIL.

Governance Principles

The Board’s Corporate Governance Principles, which include guidelines for determining director independence and qualifications for directors, are published on Vaalco’s website at www.vaalco.com. This website also makes available the charters for each of the Audit Committee, Compensation Committee, and Environmental, Social and Governance (“ESG”) Committee, and other corporate governance materials.(1) These materials are also available in print to any shareholder upon request. The Board regularly reviews corporate governance developments and modifies its Corporate Governance Principles, committee charters and key practices as warranted.

| (1) | Information appearing on or connected to our website, including our Corporate Governance Principles, the charters of our Audit, Compensation, and ESG Committees, and other corporate governance materials is not deemed to be incorporated by reference into this Proxy Statement and should not be considered part of this Proxy Statement or any other filing that we file with the SEC. |

2025 PROXY STATEMENT

Proxy Statement Summary

This summary highlights information contained elsewhere in this Proxy Statement. This summary does not contain all of the information that you should consider in making voting decisions. You should read the entire Proxy Statement carefully before voting.

Annual Meeting Information

The Board is soliciting proxies for our 2025 Annual Meeting and any adjournment, postponement or recess thereof.

| Time and Date: | 9:00 a.m. Central Time, on June 5, 2025 |

| Location: | Hilton Houston Westchase |

| 9999 Westheimer Road | |

| Houston, Texas 77042 | |

| Record Date: | April 11, 2025 |

| Proxy Materials Distribution Date: | April 25, 2025 |

| Voting Rights: | Each share of common stock is entitled to one |

| vote | |

| Electronic Access to Proxy Materials and Voting: | www.proxyvote.com |

Items of Business and Voting Recommendations

| Item for Business | Board Vote Recommendation | Further Details | |

| 1. | Election of five directors | FOR EACH DIRECTOR NOMINEE | 19 |

| 2. |

Ratification of the appointment of independent registered public accounting firm |

FOR | 38 |

| 3. | Advisory resolution on executive compensation | FOR | 42 |

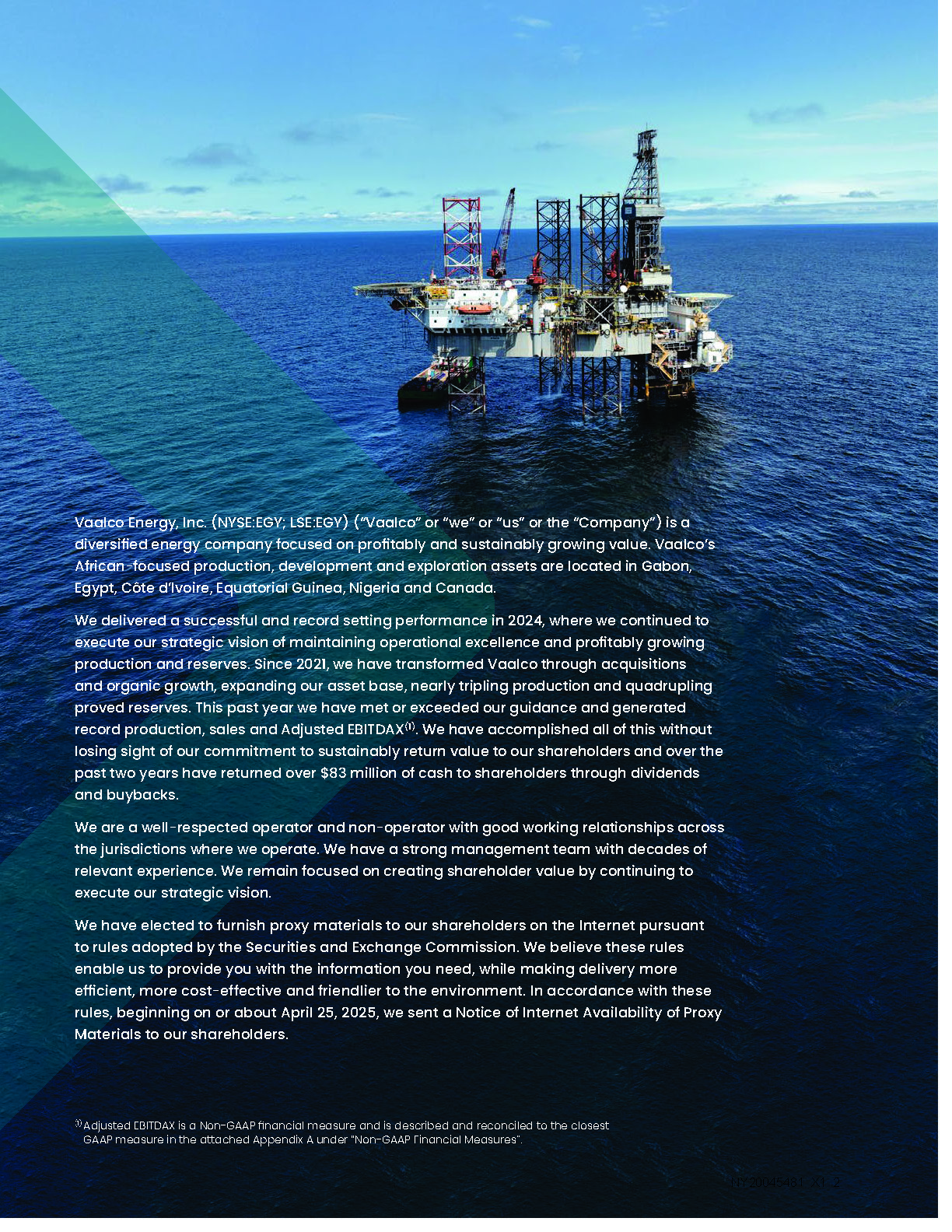

Financial and Business Information

We are a Houston, Texas-based, African-focused independent energy company with strong production and reserves across our portfolio of assets in Gabon, Egypt, Côte d’Ivoire, Equatorial Guinea, Nigeria and Canada. We engage in the acquisition, exploration, development and production of crude oil, natural gas and natural gas liquids (“NGL”).

Throughout 2024, we continued to deliver operationally and generate significant cash from operations. Our 2024 results firmly place Vaalco in a stronger position operationally and strategically, poised for future growth. Key highlights of our business and our performance in 2024 and the first part of 2025 include:

VAALCO ENERGY, INC.

2024 Full Year Highlights:

| • | Reported net income of $58.5 million ($0.56 per diluted share) and net cash from operating activities of $113.7 million; |

| • | Generated record Adjusted EBITDAX of $303.0 million; |

| • | Grew production by 7% year-over-year to 19,936 NRI BOEPD; |

| • | Sold 19,843 NRI BOEPD; |

| • | Increased year-end 2024 SEC proved reserves by 57% to 45.0 MMBOE; |

| • | Completed Production Sharing Contracts (“PSCs”) with the Government of Gabon for the offshore Niosi Marin and Guduma Marin exploration blocks; |

| • | Returned $33 million of cash to shareholders through dividends and share buybacks; and |

| • | Closed the accretive all cash acquisition of Svenska Petroleum Exploration AB (“Svenska”) for a net purchase price of $40.2 million; which- |

| • | strategically expanded our West and Central African focus area with a sizeable producing asset that has significant upside potential and future development opportunity in Cote d’Ivoire, a well-established and investment-friendly country; |

| • | paid back 1.8x(1) our initial net investment during the year, with the performance of the asset tracking well ahead of the Company’s expectations at the time of closing; |

| (1) | Payback of 1.8x is based on unaudited operational cash flow for the Côte d’Ivoire assets compared to the acquisition price of $40.2 million as of December 31, 2024. |

2025 Accomplishments to Date:

| • | Entered into new reserves-based revolving credit facility with an initial commitment of $190 million with the ability to grow to $300 million, secured by Vaalco’s Gabon, Egypt and Côte d’Ivoire assets; and |

| • | Acquired 70% WI in and will operate the CI-705 block in offshore Côte d’Ivoire. |

We focus on supporting sustainable shareholder returns and growth. Our strategic vision is to drive significant, long-term shareholder returns by maximizing the value of, and free cash flow from, our existing resource base, coupled with accretive growth.

Sustainability Highlights

We put in place practices to support the rule of law, transparency and good governance, and to oppose corruption. We believe it is also important to contribute to society through business activities, social investment and philanthropic programs. Our core values are supporting and developing our employees and communities, promoting and practicing good environmental stewardship, and improving the quality of life of the people we interact with. Below are highlights of steps we have taken to help promote these values.

2025 PROXY STATEMENT

Sustainability Oversight

Our ESG Committee oversees policies and programs relating to social responsibility and environmental sustainability. By year-end 2024 we had in place three engineers whose remit, in whole or in part, was to engineer, drive and coordinate the technical aspects of the Company’s ESG initiatives.

Since 2022, we have had a standing committee comprised of a cross section of employees, with full participation by our executive team, charged with monitoring adherence to our ESG standards and communicating findings to our ESG Committee.

In Spring 2024 we release our 2023 ESG Report, which includes key ESG sustainability metrics and a detailed analysis of our accomplishments and dedication to our people, the environment, and the countries where we operate.

We prioritize ESG metrics in our executive compensation program to drive execution on these issues. The compensation plan’s ESG score considers total recordable incident rate, carbon footprint reduction targets and company-wide participation in ESG training.

Human Capital

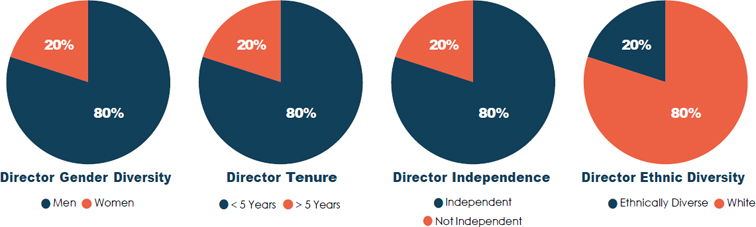

Corporate Governance. We believe our director nominees exhibit a robust mix of skills, experience, diversity and perspectives. We value building diverse teams, embracing different perspectives, fostering an inclusive environment, and supporting diversity of thought, perspective, and professional experience. We believe that diversity in culture and other demographic characteristics can help drive these values. Our governance highlights include:

| ✔ | Ms. Stubbs sits on every Board committee and chairs the Audit Committee; | |

| ✔ | 80% of our director nominees are independent; | |

| ✔ | 100% of the members of the Audit, Compensation and ESG Committee are independent; | |

| ✔ | The Chairman of the Board is independent; | |

| ✔ | All directors stand for election annually; and | |

| ✔ | In 2024, each director nominee attended 100% of the Board meetings and the meetings of the committees on which he or she served. |

VAALCO ENERGY, INC.

Diversity of our Workforce. We have a long-standing commitment to equal employment opportunity and a robust and rigorously enforced Equal Employment Opportunity policy. We are proud to disclose that, as of December 31, 2024:

| ✔ | Approximately 33% of our management team in Houston is female; | |

| ✔ | Our country manager and approximately 12% of the rest of our management team in Egypt is female; | |

| ✔ | Approximately 11% of our management team in Gabon is female; | |

| ✔ | 96% of our Gabon workforce is Gabonese; and | |

| ✔ | 85% of our Egyptian workforce is Egyptian. |

Workforce Health and Safety

We are fully committed to the health and safety of our employees and contractors. We maintain a goal of zero accidents, injuries, unsafe work practices or unsafe conditions for our employees. We prioritize and assure adequate employee training on health and safety issues. We have designed health and safety training programs to reduce risk across our operations, communicated high and insistent expectations of our partners, and created systems that support conformance to these standards.

Environmental Stewardship

We are committed to responsible environmental stewardship. We take precautions to protect natural resources and to prevent accidents from occurring. We have consistently operated vessels at our facilities within the International Convention for the Prevention of Pollution from Ships water discharge standard. In 2024, we had no regulatory reportable marine spills or loss of containment that impacted the environment.

Health, Safety and Environmental Management

In 2023, recognizing the paramount importance of Health, Safety, Security, and Environment (“HSSE”) standards across our corporate portfolio of assets, we introduced the role of HSSE Director.

The HSSE Director oversees the spectrum of HSSE concerns within our organizational framework. This includes proactively identifying potential risks, instituting robust protocols for mitigation, and ensuring that all operational endeavors adhere rigorously to benchmarks.

The HSSE Director spearheads initiatives aimed at fostering a culture of safety consciousness and environmental stewardship. By cultivating an environment where adherence to HSSE principles becomes ingrained in our corporate ethos, the HSSE Director plays an instrumental role in safeguarding not only our assets but also our reputation and societal trust, and serves as the linchpin for integrating best practices and cutting-edge methodologies into our operational framework. By remaining abreast of evolving global standards and emerging trends, the HSSE Director ensures that our organization remains poised to adapt and excel in an ever-evolving landscape.

We believe the appointment of the HSSE Director demonstrates our commitment to prioritizing safety, security, and environmental sustainability across all facets of our operations. Through his leadership and strategic vision, we continue to fortify our position as a responsible corporate citizen, dedicated to upholding our commitment to HSSE excellence on both a local and international scale.

2025 PROXY STATEMENT

Health, Safety and Environmental Management Systems. Our Incident Reporting and Analysis System was developed to effectively communicate across the various levels and functions within Vaalco safety and environmental objectives, goals and performance measures set by management. Our program incorporates numerous elements in order to achieve the highest level of risk mitigation possible. These elements include:

| ✔ | Incorporating environmental management issues and results to annual incentives; | |

| ✔ | Quarterly management auditing of offshore platforms and one HSSE certified compliance employee offshore on the platforms at all times; | |

| ✔ | Establishment of quantifiable goals with deadlines for continuous improvement of environmental protection and worker safety; | |

| ✔ | Collecting, monitoring, measuring and trending of key environmental and safety data; and | |

| ✔ | Robust safety and environmental training programs and requirements for employees and contractors. |

Greenhouse Gas Emissions. We are committed to managing our emissions and seek to identify, evaluate and measure climate-related risks by incorporating them in our management process and field development plans. During 2024, we continued to build upon our work from the previous year and have identified several areas in which we were able to achieve significant impacts on overall emissions:

| ✔ | Achieved a 12% reduction in overall Scope 1 CO2 equivalent emissions with a 6.6% reduction in CO2 equivalent intensity by maintaining a strong focus on efficient field operations across all business units; and | |

| ✔ | Implemented a field-wide hydrocarbon emissions detection and reporting program for all countries that allows for data analysis and further optimization. |

VAALCO ENERGY, INC.

Community Involvement

We take pride in our reputation as a good corporate citizen, and support the communities where we operate. We view our support and involvement in local communities as being critical to our “social license to operate.” In 2024,

| ✔ | we helped construct infrastructure to furnish clean water to local communities in Equatorial Guinea; | |

| ✔ | we provided funding to rehabilitate schools and training centers, construct water wells, install potable water systems and community solar lighting, and organize sports and other community events that improve the social fabric of local communities in Gabon; | |

| ✔ | we provided school supplies to underserved schools and material support to the families of children battling cancer in Houston; and | |

| ✔ | we planted hundreds of plants in various parks and along trails throughout Houston. |

2025 PROXY STATEMENT

Proposal No. 1

Election of Directors

Director Nominees

On March 10, 2025, the Board, upon recommendation of the ESG Committee, voted to nominate the individuals named in the table below for election. The Board asks you to elect the five nominees named below as directors for a term that expires at the 2026 Annual Meeting of Shareholders. The table below provides summary information about the five director nominees. For more information about the director nominees, see page 19.

| Name | Director Since | Independence Status | Board Committees |

| Andrew L. Fawthrop | 2014 | Independent | Audit, Compensation, ESG, Strategic, |

| Technical and Reserves | |||

| George W. M. Maxwell | 2020 | Not Independent | Strategic, Technical and Reserves |

| Cathy Stubbs | 2020 | Independent | Audit, Compensation, ESG, Strategic, |

| Technical and Reserves | |||

| Fabrice Nze-Bekale | 2022 | Independent | Audit, Compensation, ESG, Strategic |

| Edward LaFehr | 2022 | Independent | Compensation, ESG, Strategic, Technical |

| and Reserves |

Proposal No. 2

Ratification of Appointment of Independent Registered Public Accounting Firm

Auditor Ratification

The Board is asking you to ratify the selection of KPMG LLP (“KPMG”) as our independent registered public accounting firm for the fiscal year ending December 31, 2025. Even if our shareholders ratify the appointment of KPMG, the Audit Committee may, in its sole discretion, terminate such engagement and direct the appointment of another independent registered public accounting firm at any time during the year. For additional information concerning KPMG, see page 38.

VAALCO ENERGY, INC.

Proposal No. 3

Advisory Resolution on Executive Compensation

Say-on-Pay

Pursuant to Section 14A of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), we are asking our shareholders to approve, on an advisory or non-binding basis, the compensation of our named executive officers (“NEOs”) as disclosed in this Proxy Statement. For a detailed description of our executive compensation program, see “Compensation Discussion and Analysis” beginning on page 46.

Vote Required for Each Proposal

| ● | Proposal No. 1. Election of Directors. The five director nominees who receive the greatest number of “FOR” votes cast by the shareholders, a plurality, will be elected as our directors. You may vote “FOR” all the director nominees, withhold authority to vote your common stock for all the director nominees or withhold authority to vote your common stock with respect to any one or more director nominees. Withholding authority to vote your common stock with respect to one or more director nominees will have no effect on the election of those nominees. For this proposal, broker non-votes will not be taken into account for purposes of determining the outcome of the election of directors. There is no cumulative voting. If you own your shares through a broker, you must give the broker instructions to vote your shares in the election of directors if you wish for your shares to be voted. If you submit a proxy card without voting instructions for this proposal, your shares will be voted “FOR” each director, in accordance with the Board’s recommendation. |

| ● | Proposal No. 2. Ratification of Appointment of Independent Registered Public Accounting Firm. The ratification of the appointment of the independent registered public accounting firm requires the affirmative vote of a majority of votes cast affirmatively or negatively. Abstentions will not be considered “votes cast” and will have no effect on the vote. Broker non-votes have no impact on the proposal to ratify the appointment of the independent auditor because your broker has discretionary authority to vote your common stock in the absence of affirmative instructions from you with respect to this proposal. If you submit a proxy card without voting instructions, your shares will be voted “FOR” this proposal, in accordance with the Board’s recommendation. |

| ● | Proposal No. 3. Advisory Resolution on Executive Compensation. Our NEO compensation will be considered approved by our shareholders in an advisory manner upon the affirmative vote of a majority of votes cast affirmatively or negatively. For this proposal, abstentions and broker non-votes will not be considered “votes cast” and will have no effect on the vote. If you own your shares through a broker, you must give the broker instructions to vote your shares in the advisory vote on compensation of our NEOs if you wish for your shares to be voted. If you submit a proxy card without voting instructions, your shares will be voted “FOR” this proposal, in accordance with the Board’s recommendation. |

2025 PROXY STATEMENT

Voting and Other Procedures Related to the Annual Meeting

Record Date and Persons Entitled to Vote

The Board has set the close of business on April 11, 2025 as the record date for shareholders entitled to notice of and to vote at the meeting. At the close of business on the record date, there were 105,079,017 shares of Vaalco common stock outstanding and entitled to vote at the Annual Meeting. Each share of common stock is entitled to one vote.

Procedure to Access Proxy Materials Over the Internet

Your Notice or (if you received paper copies of the proxy materials) your proxy card will contain instructions on how to view our proxy materials for the Annual Meeting on the internet. Our proxy materials are also available at www.proxyvote.com.

How to Vote

The Board encourages you to exercise your right to vote. Registered shareholders can vote in person at the Annual Meeting or by proxy. Giving us your proxy means you authorize us to vote your shares at the Annual Meeting in the manner you direct. If you are a shareholder of record (you own shares in your name), there are three ways to vote by proxy:

| ● | By internet—You may vote over the internet at www.proxyvote.com by following the instructions on the Notice or, if you received your proxy materials by mail, by following the instructions on the proxy card. |

| ● | By telephone—Shareholders located in the United States that receive proxy materials by mail may vote by telephone by calling 1-800-690-6903 and following the instructions on the proxy card. |

| ● | By mail—If you received proxy materials by mail, you can vote by mail by marking, dating, signing and returning the proxy card in the postage-paid envelope. |

Telephone and internet voting will be available 24 hours a day and will close at 11:59 p.m. Eastern Time on June 4, 2025.

Voting by proxy will not limit your right to vote at the Annual Meeting if you decide to attend in person. The Board recommends that you vote by proxy since it is not practical for most shareholders to attend the Annual Meeting.

If you are a street name shareholder (that is, if your shares are held of record in the name of a bank, broker or other holder of record), you will receive instructions from the bank, broker or other record holder of your shares. Most shareholders are street name shareholders. You must follow the instructions of the holder of record (e.g., your bank or broker) in order for your shares to be voted. If you are a street name shareholder, you must obtain a proxy, executed in your favor, from the holder of record (likely your broker) to be able to vote in person at the Annual Meeting.

The shares represented by all valid proxies received by telephone, by internet or by mail will be voted in the manner specified by the shareholder. However, if you submit a proxy card that does not provide your voting instructions as to each proposal, proposals for which you do not provide instructions will be voted as follows:

| ● | FOR the nominees for directors named in this Proxy Statement; |

| ● | FOR ratification of the appointment of the independent registered public accounting firm; and |

| ● | FOR approval of the advisory resolution on executive compensation; |

VAALCO ENERGY, INC.

How to Change Your Vote; Revocability of Proxy

If you are a shareholder of record, you may later revoke your proxy instructions by:

| ● | delivering a notice of revocation to Vaalco Energy, Inc., Attn: Corporate Secretary, 2500 CityWest Blvd., Suite 400 Houston, Texas 77042; |

| ● | voting again by the internet or telephone (only the last vote cast will be counted), provided that you do so before 11:59 p.m. Eastern Time on June 4, 2025; |

| ● | submitting a properly signed proxy with a later date; or | |

| ● | voting in person at the Annual Meeting. |

If you are a street name shareholder, you may later revoke your proxy instructions by following the procedures provided by your bank, broker or other record holder that holds your shares for you.

Attending the Meeting in Person

All persons wishing to attend the Annual Meeting in person must present photo identification.

Shareholders of record must present photo identification and an admission ticket. If you received the Notice and you plan to attend the Annual Meeting, you may request an admission ticket by calling investor relations at 713- 543-3422. If you received your proxy materials by mail, an admission ticket is attached to your proxy card. If you plan to attend the Annual Meeting, please submit your proxy but keep the admission ticket and bring it with you to the Annual Meeting.

If you hold your shares in street name (e.g., you are the beneficial owner of shares held by your broker), you will need proof of ownership to be admitted to the meeting. A recent brokerage statement with your name on it, or a letter from your bank or broker, are examples of proof of ownership.

Quorum

Your stock is counted as present at the Annual Meeting if you attend the Annual Meeting and vote in person or if you properly vote by internet, telephone or mail. In order for us to hold our Annual Meeting, holders of a majority of the stock issued and outstanding and entitled to vote at the Annual Meeting must be present in person or represented by proxy at the Annual Meeting. This is referred to as a quorum. Abstentions and broker non-votes will be counted as present for purposes of determining a quorum.

2025 PROXY STATEMENT

Routine and Non-Routine Matters; Abstentions and Broker Non-Votes; Proxy Cards with No or Partial Voting Instructions

The New York Stock Exchange (“NYSE”) permits brokers to vote their customers’ stock held in street name on “routine matters” when the brokers have not received voting instructions from their customers. The NYSE does not, however, allow brokers to vote their customers’ stock held in street name on non-routine matters unless they have received voting instructions from their customers. In such cases, the uninstructed shares that the broker is unable to vote are called “broker non-votes.”

The ratification of the appointment of the independent registered public accounting firm is a routine matter on which brokers may vote in their discretion on behalf of customers who have not provided voting instructions.

The election of directors and the advisory vote to approve our executive compensation are nonroutine matters on which brokers are not allowed to vote unless they have received voting instructions from their customers.

Remember, if you submit a proxy card, any proposals for which you do not provide instructions will be voted in accordance with the Board’s recommendations.

Under Delaware law, abstentions are counted as shares present and entitled to vote at the Annual Meeting, but they are not counted as votes cast. Our bylaws provide that, except as otherwise required by law, our certificate of incorporation or the rules of any stock exchange on which our securities are listed, all matters other than the election of directors shall be determined by a majority of the votes cast affirmatively or negatively. Therefore, abstentions will have no effect on the outcome of the proposals for the ratification of the appointment of the independent registered public accounting firm or the advisory vote to approve our executive compensation.

VAALCO ENERGY, INC.

Page intentionally left blank.

2025 PROXY STATEMENT

Proxy Solicitation

In addition to sending you these materials or otherwise providing you access to these materials, some of our directors and officers as well as management and non-management employees may contact you by telephone, mail, e-mail or in person. You may also be solicited by our proxy solicitor, D.F. King & Co., by means of press releases issued by Vaalco, postings on our website at www.Vaalco.com, advertisements in periodicals, or other media forms. None of our officers or employees will receive any extra compensation for soliciting you.

We will reimburse banks, nominees, fiduciaries, brokers and other custodians for their costs of sending the proxy materials to the beneficial owners of our common stock. In addition, to assist us with our solicitation efforts, we have retained the services of D.F. King & Co., Inc. for a fee of approximately $6,500 plus out-of-pocket expenses.

Tabulation

We have designated our General Counsel to tabulate and certify the vote at the Annual Meeting.

Results of the Vote

We will announce the preliminary voting results at the Annual Meeting and disclose the final voting results in a current report on Form 8-K filed with the Securities and Exchange Commission (the “SEC”) within four business days of the date of the Annual Meeting unless only preliminary voting results are available at the time of filing the Form 8-K. To the extent necessary, we will file an amended report on Form 8-K to disclose the final voting results within four business days after the final voting results are known. You may access or obtain a copy of these and other reports free of charge on the Company’s website at www.Vaalco.com. The reports we file with the SEC are also available on the SEC’s website at www.sec.gov.

List of Shareholders

A complete list of all shareholders entitled to vote at the Annual Meeting will be open for examination by any shareholder during normal business hours for a period of ten days prior to the Annual Meeting at our offices, 2500 CityWest Blvd., Suite 400, Houston, Texas, 77042.

VAALCO ENERGY, INC.

Proposal No. 1

Election of Directors

Overview

On March 10, 2025, the Board, upon recommendation of the ESG Committee, voted to nominate the individuals named below for election. The Board asks you to elect the five nominees named below as directors for a term that expires at the 2026 Annual Meeting of Shareholders and until either they are reelected or their successors are elected and qualified:

| • | Andrew L. Fawthrop |

| • | George W. M. Maxwell |

| • | Cathy Stubbs |

| • | Fabrice Nze-Bekale |

| • | Edward LaFehr |

Each nominee currently serves as a director. Biographical information for each is contained below. No proposed nominee is being nominated for election pursuant to any arrangement or understanding between the nominee and any other person.

The Board has no reason to believe that any nominee will be unable or unwilling to serve if elected. If a nominee becomes unable or unwilling to accept nomination or election, the number of the Company’s directors will be reduced or the persons named as proxies on the accompanying proxy card, or their substitutes, will vote for the election of a substitute nominee that the Board recommends. Only the nominees designated by the Board will be eligible to stand for election as directors at the Annual Meeting.

Director Nominee Information and Qualifications

The following table provides information with respect to each nominee. Each director will be elected to serve until the next annual meeting or his or her earlier death or resignation or until his or her successor is elected and qualified.

| Name | Age | Title |

| Andrew L. Fawthrop | 72 | Director and Chairman of the Board |

| George W. M. Maxwell | 59 | Director and Chief Executive Officer |

| Cathy Stubbs | 58 | Director |

| Fabrice Nze-Bekale | 51 | Director |

| Edward LaFehr | 65 | Director |

2025 PROXY STATEMENT

The following is a brief description of the background and principal occupation of each director nominee:

|

Andrew L. Fawthrop Director and Chairman of the Board

Age: 72 Director Since: 2014 |

Andrew L. Fawthrop — Mr. Fawthrop has served on the Board since October 2014 and as the Chairman of the Board since December 2015. Mr. Fawthrop has deep and broad-based experience in the oil and gas industry, including in Africa, having served for 37 years with Unocal Corporation and Chevron Corporation (following its acquisition of Unocal in 2005) in a vast number of international leadership positions. Most recently, from January 2009 until his retirement in 2014, Mr. Fawthrop served as Chair and Managing Director for Chevron Nigeria. Prior to his assignment in Nigeria, Mr. Fawthrop served as President and Managing Director for Unocal/Chevron Bangladesh from 2003 until 2007. In his professional career, Mr. Fawthrop held various positions of increasing responsibility for exploration activities around the world in geographies including China, Egypt, Indonesia, South America, Africa, Latin America and Europe. Mr. Fawthrop served as a Member of the Advisory Board of Eurasia Group. He served as a Director of Hindustan Oil Exploration Co. Ltd. from 2003 to 2005. He was an active member of the United States Azerbaijan Chamber of Commerce, the Asia Society of Texas and the Houston World Affairs Council. Mr. Fawthrop holds a Bachelor of Science in Geology and Chemistry and a Master’s degree in Marine Geology from the University of London.

Mr. Fawthrop’s significant experience in the international exploration and production (“E&P”) industry, particularly his experience in Africa, provides a valuable resource to the Board. In addition, through his prior leadership roles and activities, he has extensive operational experience and strategy-making abilities with an executive-level perspective and knowledge base that provides a strong platform for the Board. |

George W. M. Maxwell Director and Chief Executive Officer

Age: 59 Director Since: 2020 |

George W. M. Maxwell — Mr. Maxwell became Chief Executive Officer of Vaalco on April 18, 2021. Mr. Maxwell has over 25 years of experience in the oil and gas industry, including in both the producing and service/manufacturing arenas. Mr. Maxwell founded Eland Oil & Gas Plc. in 2009 and served as the company’s Chief Executive Officer from September 2014 to December 2019, Chief Financial Officer from 2010 to 2014, and as a member of the board of directors from 2009 to 2019, until the company was acquired by Seplat Petroleum Development Company Pls. on December 17, 2019. Prior to founding Eland Oil & Gas Plc., Mr. Maxwell served as the business development manager for Addax Petroleum and, prior to this, commercial manager in Geneva. Mr. Maxwell joined Addax Petroleum in 2004 and held the general manager position in Nigeria, where he was responsible for finance, and fiscal and commercial activities. Prior to this, Mr. Maxwell worked with ABB Oil & Gas as vice president of finance based in the UK with responsibilities for Europe and Africa. He held a similar position in Houston, from where the organization ran its operations in ten countries. Mr. Maxwell was finance director in Singapore for Asia Pacific and Middle East, handling currency swaps and minimizing exposures during the Asian financial crisis of the late 1990s. Mr. Maxwell graduated from Robert Gordon University in Aberdeen with a Master’s in Business Administration. Mr. Maxwell is a Fellow of the Energy Institute in the UK and has formerly served on the boards of directors of Elcrest Exploration and Production Nigeria Ltd. and Westport Oil Limited.

Mr. Maxwell’s significant experience serving in executive leadership positions and on the boards of E&P companies, as well as his experience in mergers and acquisitions and strong ties to the London investment community, provide invaluable insight, making him an important resource for the Board. |

VAALCO ENERGY, INC.

Cathy Stubbs Director

Age: 58 Director Since: 2020 |

Cathy Stubbs — Ms. Stubbs has served on the Board since June 2020. Ms. Stubbs has over 30 years of experience in the energy industry, most recently serving 17 years with Aspire Holdings, LLC (formerly Endeavour International Corporation), an independent international oil and gas exploration and production company focused in the North Sea and United States. Ms. Stubbs held numerous roles at Aspire Holdings, LLC, including as a director and President and Chief Financial Officer from 2015 to 2021, Senior Vice President and Chief Financial Officer from 2013 to 2015, Vice President, Finance and Treasury, and served in other corporate development and accounting roles from 2004 to 2013.

Prior to joining Aspire Holdings, LLC she served as Assistant Controller, Financial Reporting and Corporate Accounting at Devon Energy, Inc. (formerly Ocean Energy, Inc.) from 1997 to 2004. Ms. Stubbs began her career in public accounting with KPMG, an international audit and business strategy consulting firm, where she rose to the title of Audit Manager. Ms. Stubbs is a Certified Public Accountant in the State of Texas and she currently serves on the board of directors of Amazing Place, and serves as the treasurer and supervisor of Memorial Villages Water Authority Board. Ms. Stubbs holds a Bachelor's degree in Business Administration, and Master's degree in Professional Accounting, from the University of Texas at Austin.

Ms. Stubbs’ significant experience in accounting, finance, risk management and her service in various director and executive roles provide a valuable resource to the Board. |

2025 PROXY STATEMENT

Fabrice Nze-Bekale Director

Age: 51 Director Since: 2022 |

Fabrice Nze-Bekale — Mr. Nze-Bekale joined the Board in 2022. He has over 25 years of experience in mining, banking, telecoms, mergers and acquisitions and international finance. Mr. Nze-Bekale has served on numerous boards and as a senior executive across his career. He currently serves as an independent director on the Board of Orabank Gabon, where he is also the Chairman of the Audit Committee and serves on the Risk Committee and Ethics and Good Governance Committee. Mr. Nze-Bekale is the Chairman of the board of directors of Airtel Money Gabon, a role he began in 2021. He was appointed to the board of directors of Gabon Power Company, the Gabonese sovereign wealth fund’s vehicle dedicated to developing PPPs in the utilities sector, in January 2024. He also began serving as the executive president of the board of directors of Gabon Angel Investing Network in 2021. From 2012 to 2020, he was a member of the Board of the Fonds Gabonais d’Investissements Strategiques, Gabon’s sovereign wealth fund. He has also served on the Boards of several Gabonese mining companies.

Mr. Nze-Bekale has been Chief Executive Officer of ACT Afrique, a leading advisory firm in West Africa and based in Dakar, Senegal, since 2017, and an executive member of the board of directors since 2020. ACT Afrique provides strategic advisory and investment banking expertise to governments as well as to public and private entities in West Africa. Prior to joining ACT Afrique, from 2012 to 2017, he served as Chief Executive Officer of Societe Equatoriale des Mines, the national mining company in Gabon, which he helped create to manage Gabon’s investments in the sector. Prior to that, he was Director of Investment Banking for Standard Bank PLC based in London from 2008 to 2011 and Finance Manager for Celtel International from 2005 to 2008. Fabrice began his career at Citibank Gabon, where he rose to become the Head of Corporate Banking. Mr. Nze-Bekale is a Gabonese national and holds a Master’s degree in Finance and Financial Engineering from the University of Paris-Dauphine (France) with a Master of Business Administration from the London Business School (UK).

Mr. Nze-Bekale’s significant experience in the areas of mining, banking, telecom and finance, his service in various director and executive roles, and his knowledge of Gabon and other West African countries make him a valuable resource for the Board. |

VAALCO ENERGY, INC.

Edward LaFehr Director

Age: 65 Director Since: 2022 |

Edward LaFehr — Mr. LaFehr joined the Board following Vaalco’s combination with TransGlobe in October 2022. Mr. LaFehr was appointed to TransGlobe’s Board of Directors in March 2019. Mr. LaFehr retired from Baytex Energy Corporation in January of 2023 after serving 6 years as President and Chief Executive Officer. Since November of 2023, Mr. LaFehr has served on the Board of Directors of STEP Energy Services Ltd. (TSE:STEP), an energy services company that provides coiled tubing, fluid and nitrogen pumping and hydraulic fracturing solutions. Mr. LaFehr has 40 years of experience in the energy industry working with Amoco, BP, Talisman, TAQA and Baytex, holding senior positions in North American, European and Middle Eastern regions. Prior to joining Baytex, he was President of TAQA’s North American energy business and subsequently Chief Operating Officer for TAQA, globally. Prior to this, he served as Senior Vice President for Talisman Energy. From 2009 to 2011 Mr. LaFehr was Managing Director of Pharaonic Petroleum Company in Cairo, Egypt. He also served on BP Egypt’s executive team and represented BP’s interests on the Board of the Pharaonic JV as well as ENI’s Petrobel JV with the Egyptian Government. Mr. LaFehr holds Master’s degrees in geophysics and mineral economics from Stanford University and the Colorado School of Mines, respectively.

Mr. LaFehr’s significant experience in executive roles at energy companies, as well as his expertise and credentials pertaining to oil, natural gas and NGL exploration, development and production, make him a valuable addition to the Board. |

Vote Required

The five director nominees who receive the greatest number of “FOR” votes cast by the shareholders, a plurality, will be elected as our directors. You may vote “FOR” all the director nominees, withhold authority to vote your common stock for all the director nominees or withhold authority to vote your common stock with respect to any one or more director nominees. Withholding authority to vote your common stock with respect to one or more director nominees will have no effect on the election of those nominees. For this proposal, broker non-votes will not be taken into account for purposes of determining the outcome of the election of directors. There is no cumulative voting. If you own your shares through a broker, you must give the broker instructions to vote your shares in the election of directors if you wish for your shares to be voted. If you submit a proxy card without voting instructions for this proposal, your shares will be voted “FOR” each director, in accordance with the Board’s recommendation.

Board Recommendation

The Board recommends that shareholders vote “FOR” the election of each of the nominees.

2025 PROXY STATEMENT

Board Composition, Independence and Communications

Board Composition

The following table provides information about each director currently serving on our Board:

● Member ● Chair

| Committee Membership | |||||||

| Name | Independent |

Director Since |

Audit | Compensation |

Environmental, Social and Governance |

Strategic | Technical and Reserves |

| Andrew L. Fawthrop Chairman of the Board |

● | 2014 | ● | ● | ● | ● | ● |

| George W.M. Maxwell | 2020 | ● | ● | ||||

| Cathy Stubbs Audit Committee Financial Expert |

● | 2020 | ● | ● | ● | ● | ● |

| Fabrice Nze-Bekale | ● | 2022 | ● | ● | ● | ● | |

| Edward LaFehr | ● | 2022 | ● | ● | ● | ● | |

The directors’ experiences, qualifications and skills that the Board considered in their re-nomination are included in their individual biographies set forth above under “Proposal No. 1—Election of Directors.”

Director Independence

It is Vaalco’s policy that a majority of the members of the Board be independent. Our common stock is listed on the NYSE and the London Stock Exchange (the “LSE”) under the symbol “EGY.” The rules of the NYSE require that a majority of the members of our Board be independent and the LSE recommends that at least a majority of the members of the Board be independent.

In assessing independence, the Board has determined that, with respect to each of Messrs. Fawthrop, Nze-Bekale, and LaFehr, and Ms. Stubbs, no material relationship exists that, in the opinion of the Board, would interfere with the exercise of independent judgment in carrying out their responsibilities as directors. In addition, the Board considered relationships and transactions involving directors or their affiliates or immediate family members that would be required to be disclosed as related party transactions and described under “—Related Party Transactions” below, of which there were none; and other relationships and transactions involving directors or their affiliates or immediate family members that would rise to the level of requiring such disclosure, of which there were none.

Based on the foregoing, the Board affirmatively determined that each of Messrs. Fawthrop, Nze-Bekale, and LaFehr, and Ms. Stubbs, qualifies as “independent” for purposes of the Company’s Corporate Governance Principles and NYSE listing rules. Mr. Maxwell does not qualify as “independent” because he is an employee of the Company.

VAALCO ENERGY, INC.

The Board has also determined that each member of the Audit Committee qualifies as independent under the audit committee independence rules established by the SEC, and meets the NYSE’s financial literacy requirements. In addition, each member of the Compensation Committee qualifies as a “non-employee director” under SEC rules.

There are no family relationships between any of our directors or executive officers.

Selection of Director Nominees

General Criteria and Process. We require that our directors display the highest personal and professional ethics and integrity, and be committed to representing the long-term interests of our shareholders. Each must also have an inquisitive and objective perspective, practical wisdom, and mature judgment. Our directors should have a complimentary range of experience in business areas that are relevant to the Company’s global activities. We believe that diversity in culture and other demographic characteristics can be important sources of complementarity.

Under its charter, the ESG Committee is responsible for determining criteria and qualifications for Board nominees to be used in reviewing and selecting director candidates, including those described in our Corporate Governance Principles. The criteria and qualifications include:

| • | personal characteristics such as integrity, education, diversity of background and experience, age, race, ethnicity and gender; |

| • | the availability and willingness to devote sufficient time to the duties of a director; |

| • | experience in corporate management, such as serving as an officer or former officer of a publicly held company; |

| • | experience in the oil and gas industry and with relevant social policy concerns; |

| • | a reputation in the community at large of integrity, trust, respect, competence and adherence to the highest ethical standards; |

| • | experience as a Board member of another publicly held company; |

| • | freedom from conflicts of interest, and whether the candidate would be independent under NYSE rules; and |

| • | practical and mature business judgment. |

These criteria and qualifications are not exhaustive, and the ESG Committee and the Board may consider other qualifications and attributes which they believe are appropriate. Other than ensuring that at least one member of the Board and the Audit Committee is a financial expert and a majority of the Board members meet applicable independence requirements, the ESG Committee retains broad discretion in determining the composition and experience of the Board as a whole. The ESG Committee evaluates potential nominees based on the contribution such nominee’s background and skills could have upon the overall functioning of the Board in light of the perceived needs of the Company at the time such evaluation is made.

The ESG Committee identifies nominees by first evaluating the current members of the Board willing to continue their service. Current members with qualifications and skills that are consistent with the ESG Committee’s criteria for Board service are frequently renominated.

2025 PROXY STATEMENT

As to new candidates, the ESG Committee will generally poll the Board and members of management for recommendations. The ESG Committee may also review the composition and qualification of the boards of directors of Vaalco’s peer group and competitors and may seek input from search firms or from industry experts or analysts. The ESG Committee then reviews the qualifications, experience and background of the candidates. Final candidates are interviewed by the independent directors and executive management. In making its determinations, the ESG Committee evaluates each individual in the context of the Board as a whole, with the objective of assembling a group with diverse backgrounds that can best represent shareholder interests through the exercise of sound judgment. After review and deliberation of all feedback and data, the ESG Committee makes its recommendation to the Board.

Shareholder Recommendation of Director Candidates. The ESG Committee considers all candidates recommended by our shareholders in accordance with the advance notice provisions of our bylaws. Shareholders may recommend candidates by writing to the Corporate Secretary at Vaalco Energy, Inc., 2500 CityWest Blvd., Suite 400, Houston, Texas 77042, stating the recommended candidate’s name and qualifications for Board membership and otherwise providing all of the information required by the advance notice provisions in our bylaws, and complying with the deadlines and timelines specified therein. When considering candidates recommended by shareholders, the ESG Committee follows the same Board membership qualifications evaluation and nomination procedures that are outlined above. Our ESG Committee has not established a minimum number of shares of common stock that a shareholder must own, or a minimum length of time during which the shareholder must own its shares of common stock, in order to recommend a director candidate for consideration.

Communicating Concerns to Directors

In order to provide our shareholders and other interested parties with a direct and open line of communication to the Board, the Board has adopted procedures for communications to directors. Our shareholders and other interested persons may communicate with the Chair of our Audit Committee or with our non-employee directors as a group, by written communications addressed in care of Corporate Secretary, Vaalco Energy, Inc., 2500 CityWest Blvd., Suite 400, Houston, Texas 77042.

All communications received in accordance with these procedures will be reviewed initially by our Corporate Secretary who will relay all such communications to the appropriate director or directors unless it is determined that the communication:

| • | does not relate to our business or affairs or the functioning or constitution of the Board or any of its committees; |

| • | relates to routine or insignificant matters or matters that do not warrant the attention of the Board; |

| • | is an advertisement or other commercial solicitation or communication; |

| • | is a resume or other form of job inquiry; |

| • | is frivolous or offensive; or |

| • | is otherwise not appropriate for delivery to directors. |

VAALCO ENERGY, INC.

A director who receives any such communication will have discretion to determine whether the subject matter of the communication should be brought to the attention of the full Board or one or more of its committees and whether any response to the person sending the communication is appropriate. Any such response will be made only in accordance with applicable law and regulations relating to the disclosure of information.

The Corporate Secretary will retain copies of all communications received pursuant to these procedures for a period of at least one year. The Board will review the effectiveness of these procedures from time to time and, if appropriate, recommend changes.

2025 PROXY STATEMENT

Corporate Governance

Board Risk Oversight

While the Board, with input from each of its committees, oversees Vaalco’s risk management function, Vaalco’s management team is responsible for the execution of our day-to-day risk management process. The Audit Committee reviews with management, as well as internal and external auditors, the Company’s business risk management process, including the adequacy of Vaalco’s overall control environment and controls in selected areas representing significant financial and business risk, including cybersecurity. The Audit Committee periodically discusses its assessment with management and considers the impact of risk on our financial position and the adequacy of our risk-related internal controls. Our Compensation Committee considers risks that could be implicated by our compensation programs, including whether they encourage excessive risk-taking. Our Technical and Reserves Committee oversees the evaluation and reporting of the Company’s oil, gas and NGL reserves, and our ESG Committee annually reviews the effectiveness of our leadership structure and manages succession planning. Each Board committee, as well as senior management, reports regularly to the full Board.

Succession Planning

A key responsibility of our CEO and Board is to ensure that an effective process is in place to provide continuity of leadership over the long-term. Each year, a review of senior leadership succession is conducted by the Board based upon the recommendation of the ESG Committee. During this review, the CEO and the independent directors discuss candidates for senior leadership positions, succession timing for those positions, and development plans for high-potential candidates. This process forms the basis for ongoing leadership assignments.

Board Leadership Structure

Our current board structure separates the roles of Chief Executive Officer and Chairman of the Board, with Mr. Maxwell serving as Chief Executive Officer and Mr. Fawthrop serving as Chairman of the Board. We believe this leadership structure allows Mr. Maxwell to focus primarily on our day-to-day operations and the implementation of our strategic, financial and management policies and allows Mr. Fawthrop to lead our Board in the identification of strategic priorities and the evaluation of strategy execution. The Board currently believes that this distribution of oversight is the best method of ensuring optimal Company performance and risk management.

Our Corporate Governance Principles provide that in the event the Chairman of the Board is not an independent director, or when the independent directors determine that it is in the best interests of the Company, the independent directors will also appoint a lead independent director. The primary role of the lead independent director would be to ensure independent leadership of the Board, as well as to act as a liaison between the non-management directors and our Chief Executive Officer. Because our Chair of the Board is an independent director, our Board has determined that a lead independent director is not currently required.

Board Evaluation

We believe a rigorous Board evaluation process is important to the effectiveness of our Board. To that end, our ESG Committee annually assesses the performance of the Board. As part of the evaluation, the ESG Committee reviews areas in which they or management believe the Board can make a better contribution to the governance of the Company. Additionally, each of our Board committees conducts an annual evaluation of its own performance.

VAALCO ENERGY, INC.

We have an insider trading policy that prohibits our officers, directors and employees from purchasing or selling our securities in the open market while being aware of material, non-public information about the Company and disclosing such information to others who may trade in securities of the Company.

Our insider trading policy also prohibits our officers, directors and employees from engaging in hedging activities or other short-term or speculative transactions in the Company’s securities such as zero-cost collars and forward sale contracts. We believe that these hedging transactions would allow those covered by our insider trading policy to own our securities without the full risks and rewards of ownership, which could result in misalignment between our general shareholders and the individual engaging in the hedge. In addition, our insider trading policy prohibits all covered persons from pledging our securities or using them as collateral for a loan or as part of a margin account without the consent of our Board. The Board believes the Insider Trading Policy is reasonably designed to promote compliance with insider trading laws, rules and regulations, and the exchange listing standards applicable to us. A copy of our Insider Trading Policy was filed as Exhibit 19.1 to our Annual Report on Form 10-K for the year ended December 31, 2024. For additional information, see “Compensation Discussion and Analysis—Other Compensation Information—Prohibition on Hedges and Pledges.”

Stock Ownership Guidelines

The Board believes that it is in the best interests of the Company and its shareholders to align the financial interests of the officers of the Company and of the Board with those of the Company’s shareholders. To effect this, the Board enforces minimum stock ownership guidelines that require that the individuals noted below hold an interest in the Company’s stock as follows:

| Title | Stock Ownership Requirement |

| Chief Executive Officer | Three (3) times annual base salary |

| Independent Director | Five (5) times annual cash director retainer |

| Chief Financial Officer | Three (3) times annual base salary |

| Other Executive Officers | Two (2) times annual base salary |

In general, the forms of equity ownership that can be used to satisfy the ownership requirements include shares held directly, unvested shares of restricted stock, and vested share-settled equity awards that have been deferred. Our guidelines do not count unexercised stock options, vested and unexercised stock appreciation rights (“SARs”), or cash-settled awards towards the ownership requirements.

Each officer and director has five years from the adoption of the policy or date of appointment, whichever is later, to attain compliance with the ownership requirement and, until a covered individual is in compliance, he or she must retain an amount equal to 60% of the net shares received since appointment as a result of the exercise, vesting or payment of any Company equity awards granted. If, for any reason, an individual’s ownership falls below the requirement, he or she is again required to retain 60% of any future awards until the ownership requirement is again attained.

Compliance with this policy is reviewed by the ESG Committee on an annual basis, and the ESG Committee may exercise its discretion in response to any violation of this policy. In addition, the Compensation Committee will take into account compliance with the requirements in determining grants of long-term incentive plan awards or annual equity retainers. The ESG Committee found all directors and officers to be in compliance in 2024.

2025 PROXY STATEMENT

Code of Ethics and Corporate Governance Documents

We have adopted a Code of Business Conduct and Ethics for Directors, Officers and Employees and a Code of Ethics for the Chief Executive Officer and Senior Financial Officers. Both codes are available on our website at www. Vaalco.com. Our website also includes copies of the other corporate governance policies we have adopted, including our Corporate Governance Principles, and the charters of our Audit, Compensation and ESG Committees. Print copies of these documents are available upon request by contacting our investor relations group.(1)

We have not granted any waivers to our codes of ethics to any of our directors or executive officers. To the extent required by law or regulation, we intend to post any waivers or amendments to our codes of ethics on our website.

| (1) | Information appearing on or connected to our website, including our Code of Business Conduct and Ethics for Directors, Officers and Employees, Code of Ethics for the Chief Executive Officer and Senior Financial Officers, corporate governance policies, including our Corporate Governance Principles, and the charters of our Audit, Compensation and ESG Committees, is not deemed to be incorporated by reference into this Proxy Statement and should not be considered part of this Proxy Statement or any other filing that we file with the SEC. |

Environmental, Social and Corporate Governance

We believe that in addition to being the right thing, operating our business ethically and responsibly is key to our long-term success. Social and environmental values guide how we manage our business and allow us to help local economies thrive. These three values are foundational: (i) a commitment to the safety of our employees and the environment, (ii) a commitment to society and local communities, and (iii) a commitment to high ethical standards. Our Board’s experience in the oil and gas sector, and in Africa, provides a strong foundation to oversee ESG issues facing Vaalco and our industry.

Commitment to World-Class Safety. The health and safety of our employees, our contractors, and the communities where we operate are important to us. Our commitment to safe operations is foundational to our business strategy and reflects our unwavering commitment to preserve and maintain our excellent HSSE record. In light of this commitment, we are engaged in efforts to align our safety management systems with international standards, such as ISO 45001, which is the International Organization for Standardization’s standard for management systems of occupational health and safety published in March 2018. In addition, we regularly engage in process safety management training and have developed our own “people-based” safety program.

We foster environmental stewardship through continuous training programs, dedicated emergency environmental response capabilities, and being highly conscious of any environmental impact of our operations, including impacts on carbon emissions and biodiversity. During 2020, we undertook a comprehensive baseline study to more fully understand and manage our carbon footprint. In 2023, we recalibrated and expanded the model to capture our newly acquired assets in Canada and Egypt. The baseline study comprised building a greenhouse gas emissions inventory and diagnostic across the entire operating base and asset integrity audits. This baseline allows us to make better and more informed decisions about our carbon reduction strategy. In 2024, we undertook a comprehensive technical audit of carbon data collection, emission calculations and data retention in Gabon, along with a Company-wide environmental, social, health and safety assessment. This is all part of our long-term commitment to responsible operations that minimize adverse environmental impacts.

VAALCO ENERGY, INC.

Our commitment to safety is directly reflected in our compensation philosophy. Our Compensation Committee considers safety performance as an annual factor in determining the annual bonuses payable to our NEOs. We believe that linking executive remuneration to safety performance helps directly incentivize our executives to instill a safety-first culture Commitment to Society and Local Communities.

We are committed to supporting the development of the local communities where we operate. Ninety-six percent of our local workforce in Gabon are Gabonese, and 100% of female management employees in Gabon are Gabonese. Eighty-five percent of our local workforce in Egypt are Egyptian, and 100% of female management employees in Egypt are Egyptian. Within our Houston offices, 31% of our workforce is female and 33% of those in Houston serving in management roles are female. Approximately 27% of our workforce in Canada is female. Our company hiring practices are based on the foundation that we do not discriminate based on race, religion, color, national origin, physical disability, sex, sexual orientation, or age in hiring.

Commitment to Ethics. We hold our business and employees to the highest ethical standards. Our corporate governance policies are designed to conform to both SEC guidelines and the U.K. Corporate Governance Code and are overseen by our Board. We do not tolerate bribery or corruption and we rigorously educate our employees on compliance with applicable anticorruption laws.

We believe a commitment to high ethical standards benefits our investors, employees, customers, suppliers, governments, communities, business partners and all others who have a stake in how we operate.

Governing our Operations. Vaalco remains committed to cultivating a culture anchored in ethical principles, adherence to the law, and personal accountability among ourselves and in our engagements with governments, contractors, and business partners. Our corporate policies set our standards for ethical conduct and are applicable to all personnel.

ESG Report. It is right, and it is necessary for our long-term success, to operate our business ethically and responsibly. This includes operating in a manner that takes into account our environmental impact. We encourage you to review the “Sustainability” section of our website, www.Vaalco.com, for details. You can also view our most recent ESG Report there.(1)

| (1) | Information appearing on or connected to our website, including our ESG Report, is not deemed to be incorporated by reference into this Proxy Statement and should not be considered part of this Proxy Statement or any other filing that we file with the SEC. |

Compensation Committee Interlocks and Insider Participation

The current members of the Compensation Committee are Andrew L. Fawthrop, Edward LaFehr, Fabrice Nze-Bekale, and Cathy Stubbs.

None of our executive officers serves as a member of the compensation committee of any other company that has an executive officer serving as a member of our Compensation Committee or our Board. None of our executive officers serves as a member of the board of directors of any other company that has an executive officer serving as a member of our Compensation Committee. There are no Compensation Committee interlocks or relationships with any company our directors are affiliated with.

2025 PROXY STATEMENT

Board Committee Membership and Meetings

Committees of Directors

Our Board has three standing, regular committees: the Audit Committee, the Compensation Committee and the ESG Committee. Each has a charter that governs its duties and responsibilities, which is available on Vaalco’s website at www.Vaalco.com.(1) Each committee is operated according to the rules of the NYSE and each committee member meets the applicable independence requirements of the NYSE and SEC. Our Board has also determined that each member of the Compensation Committee constitutes a “non-employee director” for purposes of Rule 16b-3 promulgated under the Exchange Act.

In addition to our three regular committees, the Board has a Strategic Committee that was formed to oversee evaluations of certain strategic alternatives for our Company and a Technical and Reserves Committee to oversee the review, evaluation and reporting of the Company’s oil, gas and NGL reserves and production.

Each of our Board committees reports to the Board. The composition, duties and responsibilities of our Board committees are described below.

| (1) | Information appearing on or connected to our website, including the charters of our Audit, Compensation and ESG Committees, is not deemed to be incorporated by reference into this Proxy Statement and should not be considered part of this Proxy Statement or any other filing that we file with the SEC. |

| Audit Committee | ||

| Current Membership | Committee Functions | |

|

Ms. Cathy Stubbs (Chair) Mr. Andrew L. Fawthrop Mr. Fabrice Nze-Bekale |

• | Selects and reviews the qualifications, performance, and independence of the independent registered public accounting firm |

| • | Reviews reports of independent and internal auditors | |

| • | Reviews and pre-approves the scope and cost of all services (including non-audit services) provided by the independent registered public accounting firm | |

| • | Monitors the effectiveness of the audit process and financial reporting | |

| • | Reviews the adequacy of financial and operating controls | |

| • | Monitors the Company’s compliance with applicable legal and regulatory requirements and Company policies | |

| • | Reviews and approves or ratifies all related person transactions in accordance with Company’s policies and procedures | |

The Board has determined that each Audit Committee member is financially literate within the meaning of NYSE listing standards. In addition, the Board has determined that Ms. Stubbs qualifies as an “audit committee financial expert” in accordance with SEC rules and the professional experience requirements of the NYSE. Designation as an “audit committee financial expert” does not impose any duties, obligations, or liabilities that are greater than those imposed on other members of the Audit Committee and the Board, and such designation does not affect the duties, obligations, or liability of any other member of the Audit Committee or the Board.

Under its charter, the Audit Committee is authorized to engage independent advisors at the Company’s expense for advice on any matters within the scope of the Audit Committee’s duties. The Audit Committee may also form subcommittees and delegate its authority to those subcommittees as it deems appropriate.

VAALCO ENERGY, INC.

| Compensation Committee | ||

| Current Membership | Committee Functions | |

|

Mr. Andrew L. Fawthrop (Chair) Ms. Cathy Stubbs Mr. Fabrice Nze-Bekale Mr. Edward LaFehr |